(Analysis of Amortization Schedule and Interest Entries) The following amortization and interest schedule reflects the issuance of...

Question:

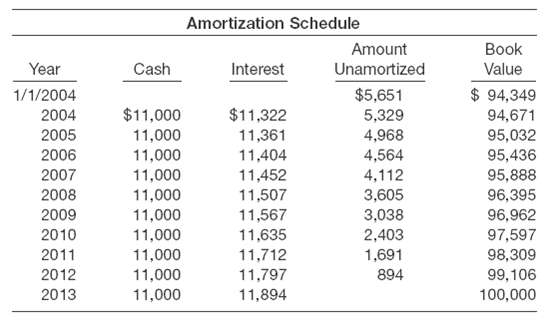

(Analysis of Amortization Schedule and Interest Entries) The following amortization and interest schedule reflects the issuance of 10-year bonds by Capulet Corporation on January 1, 2004, and the subsequent interest payments and charges. The company's year-end is December 31, and financial statements are prepared once yearly.

(a) Indicate whether the bonds were issued at a premium or a discount and how you can determine this fact from the schedule.

(b) Indicate whether the amortization schedule is based on the straight-line method or the effective interest method and how you can determine which method is used.

(c) Determine the stated interest rate and the effective interest rate.

(d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2004.

(e) On the basis of the schedule above, prepare the journal entry or entries to reflect the bond transactions and accruals for 2004. (Interest is paid January 1.)

(f) On the basis of the schedule above, prepare the journal entry or entries to reflect the bond transactions and accruals for 2011. Capulet Corporation does not use reversingentries.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Bonds

When companies need to raise money, issuing bonds is one way to do it. A bond functions as a loan between an investor and a corporation. The investor agrees to give the corporation a specific amount of money for a specific period of time in exchange... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield