A firm with a 14% WACC is evaluating two projects for this years capital budget. After-tax cash

Question:

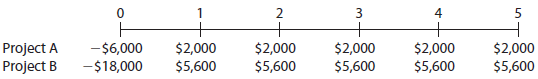

A firm with a 14% WACC is evaluating two projects for this year’s capital budget. After-tax cash flows, including depreciation, are as follows:

a. Calculate NPV, IRR, MIRR, payback, and discounted payback for each project.

b. Assuming the projects are independent, which one(s) would you recommend?

c. If the projects are mutually exclusive, which would you recommend?

d. Notice that the projects have the same cash flow timing pattern. Why is there a conflict between NPV and IRR?

2 Project A Project B $2,000 $2,000 $5,600 $2,000 $5,600 -$6,000 -$18,000 $2,000 $5,600 $2,000 $5,600 $5,600

Step by Step Answer:

a Project A CF 0 6000 CF 15 2000 IYR 14 Solve for NPV A 86616 IRR A 1986 MIRR calculation Using a fi...View the full answer

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Corporate Finance questions

-

A firm with 14 percent WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: A) Calculate NPV, IRR, MIRR, payback, and...

-

The Sanders Electric Company is evaluating two projects for possible inclusion in the firms capital budget. Project M will require a $37,000 investment while project Os investment will be $46,000....

-

The management of Gawain plc is evaluating two projects whose returns depend on the future state of the economy as shown below: Probability __________ IRRA(%) ___________ IRRB(%)...

-

Problem Set 3 b. zero. c. negative. d. smaller than the variance. 22. Growth factors for the population of Atlanta in the past five years have been 1, 2, 3, 4, and 5. The geometric mean is a. 15. b....

-

Which financial statement presents information related to changes in retained earnings and share repurchase?

-

What is the most likely complication that the patient may experience, and how will it prevent, identify and treat Autism?

-

Describe how intentional torts and negligence differ.

-

Wendy and Frank Cotroni, ages 30 and 35, plan to purchase life insurance. Wendy does not have any coverage, while Frank has a $150 000 policy at work. The Cotronis have two children, ages three and...

-

Vicky was an employee during 2 0 2 3 and she received the following income and benefits from her employer: Salaries paid and received in 2 0 2 3 - $ 4 2 , 0 0 0 Bonus declared by her employer on...

-

A series of computer and backup system failures caused the loss of most of the company records at Stotter, Incorporated. Information technology consultants for the company could recover only a few...

-

Your division is considering two projects with the following net cash flows (in millions): a. What are the projects? NPVs assuming the WACC is 5%? 10%? 15%? b. What are the projects? IRRs at each of...

-

A mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an...

-

Would each of the following changes increase or decrease the break-even sales growth rate? a. An increase in the amount of inventory held c. A decrease in the amount of inventory held d. A decrease...

-

A firefly glows by the direct conversion of chemical energy to light. The light emitted by a firefly has peak intensity at a wavelength of \(550 \mathrm{~nm}\). a. What is the minimum chemical...

-

You have seen that filled electron energy levels correspond to chemically stable atoms. A similar principle holds for nuclear energy levels; nuclei with equally filled proton and neutron energy...

-

What is the energy (in \(\mathrm{MeV}\) ) released in the alpha decay of \({ }^{228} \mathrm{Th}\) ?

-

At \(510 \mathrm{~nm}\), the wavelength of maximum sensitivity of the human eye, the dark-adapted eye can sense a 100-ms-long flash of light of total energy \(4.0 \times 10^{-17} \mathrm{~J}\)....

-

The radioactive hydrogen isotope \({ }^{3} \mathrm{H}\) is called tritium. It decays by beta-minus decay with a half-life of 12.3 years. a. What is the daughter nucleus of tritium? b. A watch uses...

-

(a) The circuit in Figure P10-35 is in the zero state. Find the Thvenin equivalent to the left of the interface. (b) A \(0.22-\mu \mathrm{F}\) capacitor is connected across the interface in Figure...

-

This problem continues the Draper Consulting, Inc., situation from Problem 12-45 of Chapter 12. In October, Draper has the following transactions related to its common shares: Oct 1 Draper...

-

A chemical dictionary gives the following descriptions of the production of some compounds. Write plausible chemical equations based on these descriptions. (a) Lead(II) carbonate: adding a solution...

-

SKI tries to match the maturity of its assets and liabilities. Describe how SKI could adopt a more aggressive or a more conservative financing policy.

-

Assume that SKIs payables deferral period is 30 days. Now calculate the firms cash conversion cycle .

-

What might SKI do to reduce its cash and securities without harming operations?

-

How does the concept of social order emerge from the micro-level interactions between individuals, and how do disruptions or deviations from established norms and expectations affect this order?

-

A toy rocket follows a parabolic path. The height of the rocket f(x), in feet, can be modeled by f(x) =-0.04x + 4x where x represents the rocket's horizontal distance in feet. Find the maximum height...

-

What are the tri - component attitude model and its applications. Explain.

Study smarter with the SolutionInn App