Comprehensive problem on unit costs, product costs Tampa Office Equipment manufactures and sells metal shelving. It began

Question:

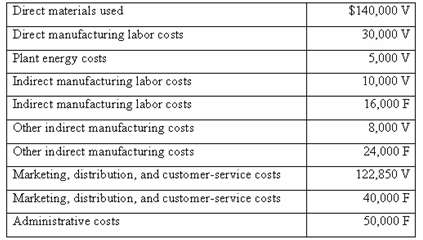

Comprehensive problem on unit costs, product costs Tampa Office Equipment manufactures and sells metal shelving. It began operations on January 1, 2009. Costs incurred for 2009 are as follows (V stands for variable; F stands for fixed):

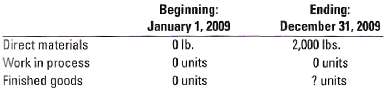

Variable manufacturing costs are variable with respect to units produced. Variable marketing, distribution, and customer-service costs are variable with respect to units sold. Inventory data are:

Production in 2009 was 100,000 units. Two pounds of direct materials are used to make one unit of finished product. Revenues in 2009 were $436,800. The selling price per unit and the purchase price per pound of direct materials were stable throughout the year. The company's ending inventory of finished goods is carried at the average unit manufacturing cost for 2009. Finished-goods inventory at December31, 2009, was $20,970.

1. Calculate direct materials inventory, total cost, December31, 2009

2. Calculate finished-goods inventory, total units, December 31, 2009.

3. Calculate selling price in 2009.

4. Calculate operating income for 2009.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav