Activity-based costing, merchandising Pharmacare, Inc., a distributor of special pharmaceutical products, operates at capacity and has three

Question:

Activity-based costing, merchandising Pharmacare, Inc., a distributor of special pharmaceutical products, operates at capacity and has three main market segments:

a. General supermarket chains

b. Drugstore chains

c. Mom-and-Pop single-store pharmacies

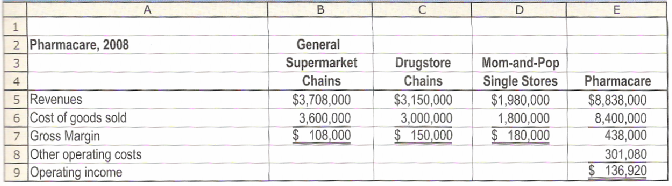

Rick Flair, the new controller of Pharmacare, reported the following data for 2008:

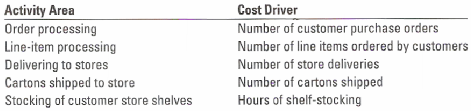

For many years, Pharmacare has used gross margin percentage [(Revenue — Cost of goods sold) ÷ Revenue] to evaluate the relative profitability of its market segments. But, Flair recently attended a seminar on activity-based costing and is considering using it at Pharmacare to analyze and allocate “other operating costs.” He meets with all the key managers and several of his operations and sales staff and they agree that there are five key activities that drive other operating costs at Pharmacare:

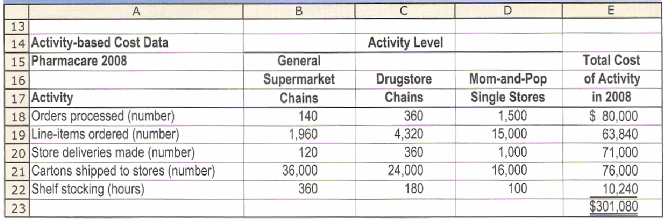

Each customer order consists of one or more line items. A line item represents a single product (such as Extra-Strength Tylenol Tablets). Each product line item is delivered in one or more separate cartons. Each store delivery entails the delivery of one or more cartons of products to a customer. Pharmacare’s staff stacks cartons directly onto display shelves in customers’ stores. Currently, there is no additional charge to the customer for shelf-stocking and not all customers use Pharmacare for this activity. The level of each activity in the three market segments and the total cost incurred for each activity in 2008 is shown below:

If you want to use Excel to solve this problem, go to the Excel Lab at www.prenhall.com/horngren/cost13e and download the template for Problem 5-34.

1. Compute the 2008 gross-margin percentage for each of Pharmacare’s three market segments.

2. Compute the cost driver rates for each of the five activity areas.

3. Use the activity-based costing information to allocate the $301,080 of “other operating costs” to each of the market segments. Compute the operating income for each market segment.

4. Comment on the results. What new insights are available with the activity-based costing information?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav