Choosing cost drivers, activity-based costing, activity-based management. Annie Warbucks runs a dance studio with childcare and adult

Question:

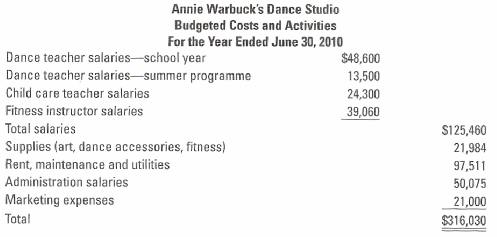

Choosing cost drivers, activity-based costing, activity-based management. Annie Warbucks runs a dance studio with childcare and adult fitness classes. Annie’s budget for the upcoming year is as follows:

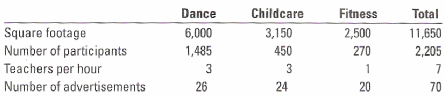

Other information:

Dance classes 3 per hour

Hours of operation

(Dance, Childcare and Fitness)—school year (36 weeks) 2 p.m. to 8 p.m. M—F

Hours of operation

(Dance, Childcare and Fitness)—summer programme (10 weeks) 9 am. to noon; 1 p.m. to 4p.m. M—F

Other information:

1. Determine which costs are direct costs and which costs are indirect costs of different programs.

2. Choose a cost driver for the indirect costs and calculate the cost per unit of the cost driver. Explain briefly your choice of cost driver.

3. Calculate the budgeted costs of each program.

4. How can Annie use this information for pricing? What other factors should she consider?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav