Kaj Rasmussen founded Scandi Home Furnishings as a corporation during mid-2007. Sales during the first full year

Question:

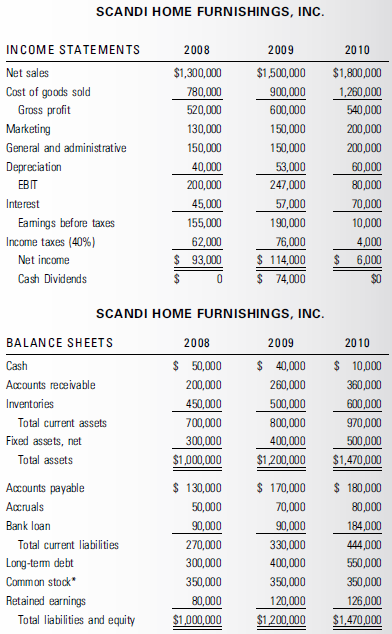

Kaj Rasmussen founded Scandi Home Furnishings as a corporation during mid-2007. Sales during the first full year (2008) of operation reached $1.3 million. Sales increased by 15 percent in 2009 and another 20 percent in 2010. However, after increasing in 2009 over 2008, profits fell sharply in 2010, causing Kaj to wonder what was happening to his "pride-and-joy" business venture. After all, Kaj worked as closely as possible to a 24/7 pace, beginning with the startup of Scandi and continuing through the first three full years of operation.

*350,000 shares of common stock were issued to Kaj Rasmussen and the venture investors when Scandi Home Furnishings was incorporated in mid-2007.

Part A

Your first challenge is to advise Kaj on what has been happening with Scandi Home Furnishings from a liquidity perspective.

A. Kaj was particularly concerned by the drop in cash from $50,000 in 2007 to $10,000 in 2010. Calculate the average current ratio, the quick ratio, and the NWC-to-total-assets ratio for 2008-2009 and 2009-2010. What has happened to Scandi's liquidity position?

B. An analysis of the cash conversion cycle should also help Kaj understand what has been happening to the operations of Scandi. Prepare an analysis of the average conversion periods for the three components of the cash conversion cycle for 2008-2009 and 2009-2010. Explain what has happened in terms of each component of the cycle.

C. Kaj should be interested in knowing whether Scandi has been building or burning cash. Compare the cash build, cash burn, and the net cash build/burn positions for 2009 and 2010. What, if any, changes have occurred?

Part B

Your second challenge is to advise Kaj on what has been happening to Scandi from a financial leverage, profitability, and efficiency perspective.

D. Creditors, as well as management, are also concerned about the ability of the venture to meet its debt obligations as they come due, the proportion of current liabilities to total debt, the availability of assets to meet debt obligations in the event of financial distress, and the relative size of equity investments to debt levels. Calculate average ratios in each of these areas for the 2008-2009 and 2009-2010 periods. Interpret your results and explain what has happened to Scandi.

E. Of importance to Kaj and the venture investors is the efficiency of the operations of the venture. Several profit margin ratios relating to the income statement are available to help analyze Scandi's performance. Calculate average profit margin ratios for 2008-2009 and 2009-2010 and describe what is happening to the profitability of Scandi Home Furnishings.

F. Kaj and the venture investors are also interested in how efficiently Scandi is able to convert its equity investment, as well as the venture's total assets, into sales. Calculate several ratios that combine data from the income statements and balance sheets and compare what has happened between the 2008-2009 and 2009-2010 periods.

G. An ROA model consisting of the product of two ratios provides an overview of a venture's efficiency and profitability at the same time. An ROE model consists of the product of three ratios and simultaneously shows an overview of a venture's efficiency, profitability, and leverage performance. Calculate ROA and ROE models for the 2008-2009 and 2009-2010 periods. Provide an interpretation of your findings.

Part C

Your third challenge is to advise Kaj on what has been happening to Scandi relative to financial developments in the home furnishings industry.

H. Kaj has been able to obtain some industry ratio data from the home furnishings industry trade association of which he is a member. The industry association collects proprietary financial information from members of the association, compiles averages to protect the proprietary nature of the information, and provides averages for use by individual trade association members. Over the 2008-2009 and 2009-2010 periods, the inventory-to-sale conversion period has averaged 200 days, while the sale-to-cash conversion period (days of sales outstanding) for the industry has averaged 60 days. How did Scandi's operations compare with these industry averages in terms of these two components of the cash conversion cycle?

I. Trade association data for the home furnishings industry show an average net profit margin of 6.5 percent, a sales-to-assets ratio of 1.3 times, and a total-debt-to-total-assets ratio of 55 percent over the 2008-2009 and 2009-2010 periods. Compare and contrast Scandi's results with the industry average in terms of the ROA and ROE models. Make sure you compare the components of each model as well as the product of the components.

Cash conversion cycle measures the total time a business takes to convert its cash on hand to produce, pay its suppliers, sell to its customers and collect cash from its customers. The process starts with purchasing of raw materials from suppliers,... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Entrepreneurial Finance

ISBN: 978-0538478151

4th edition

Authors: J . chris leach, Ronald w. melicher