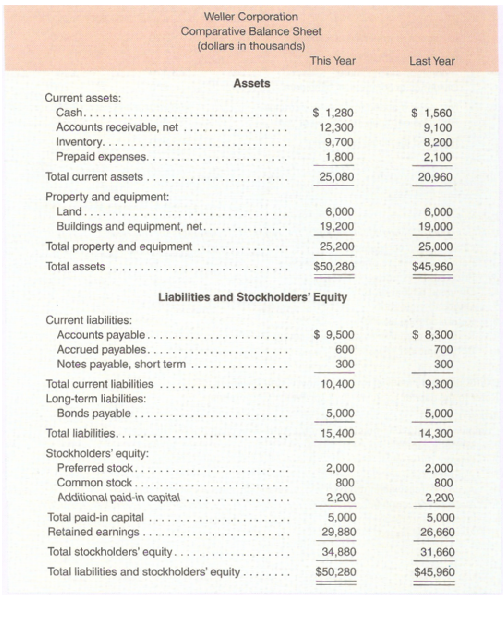

Comparative financial statements for Weller Corporation for the fiscal year ending December 31 appear below. The company

Question:

Comparative financial statements for Weller Corporation for the fiscal year ending December 31 appear below. The company did not issue any new common or preferred stock during the year. A total of 800,000 shares of common stock were outstanding. The interest rate on the bond payable was 12%, the income tax rate was 40%, and the dividend per share of common stock was $0.25. The market value of the company’s common stock at the end of the year was $18. All of the company’s sales are on account.

Required:

Compute the following financial ratios for common stockholders for this year:

- Gross margin percentage.

- Earnings per share of common stock.

- Price-earnings ratio.

- Dividend payout ratio.

- Dividend yield ratio.

- Return on total assets.

- Return on common stockholders’ equity.

- Book value per share.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Financial Ratios

The term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

Question Posted: