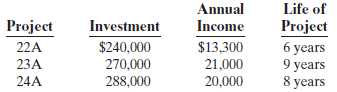

Omega Company is considering three capital expenditure projects. Relevant data for the projects are as follows. Annual

Question:

Omega Company is considering three capital expenditure projects. Relevant data for the projects are as follows.

Annual income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Omega Company uses the straight-line method of depreciation.

Instructions

(a) Determine the internal rate of return for each project. Round the internal rate of return factor to three decimals.

(b) If Omega Company’s minimum required rate of return is 11%, which projects are acceptable?

Internal Rate of ReturnInternal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted: