Midwest Entertainment has four operating divisions: Bus Charters, Lodging, Concerts, and Ticket Services. Each division is a

Question:

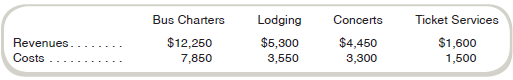

Midwest Entertainment has four operating divisions: Bus Charters, Lodging, Concerts, and Ticket Services. Each division is a separate segment for financial reporting purposes. Revenues and costs related to outside transactions were as follows for the past year (dollars in thousands):

Bus Charters Division participates in a frequent guest program with Lodging Division.

During the past year, Bus Charters reported that it traded lodging award coupons for travel that had a retail value of $1.3 million, assuming that the travel was redeemed at full fares. Concerts Division offered 20 percent discounts to Midwest’s bus passengers and lodging guests. These discounts to bus passengers were estimated to have a retail value of $350,000. Midwest’s lodging guests redeemed $150,000 in concert discount coupons. Midwest’s hotels also provided rooms for Bus Charters’s employees (drivers and guides). The value of the rooms for the year was $650,000.

The Ticket Services Division sold chartered tours for Bus Charters valued at $200,000 for the year. This service for intra-company lodging was valued at $100,000. It also sold concert tickets for Concerts; tickets for intra-company concert admission were valued at $50,000.

While preparing all of these data for financial statement presentation, Lodging Division’s controller stated that the value of the bus coupons should be based on their differential and opportunity costs, not on the full fare. This argument was supported because travel coupons are usually allocated to seats that would otherwise be empty or that are restricted similar to those on discount tickets. If the differential and opportunity costs were used for this transfer price, the value would be $250,000 instead of $1.3 million. Bus Charters’s controller made a similar argument concerning the concert discount coupons. If the differential cost basis were used for the concert coupons, the transfer price would be $50,000 instead of the $350,000.

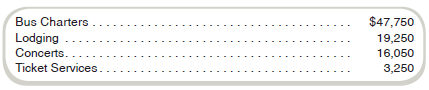

Midwest reports assets in each division as follows (dollars in thousands):

Required

a. Using the retail values for transfer pricing for segment reporting purposes, what are the operating profits for each Midwest division?

b. What are the operating profits for each Midwest division using the differential cost basis for pricing transfers?

c. Rank each division by ROI using the transfer pricing methods in (a) and (b). What difference does the transfer pricing system have on the rankings?

Step by Step Answer:

Fundamentals of Cost Accounting

ISBN: 978-0077398194

3rd Edition

Authors: William Lanen, Shannon Anderson, Michael Maher