South Seas Products, Inc., has designed a new surfboard to replace its old surfboard line. Because of

Question:

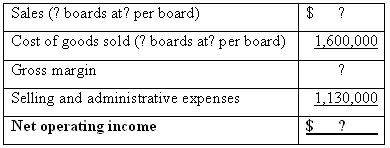

South Seas Products, Inc., has designed a new surfboard to replace its old surfboard line. Because of the unique design of the new surfboard, the company anticipates that it will be able to sell all the boards that it can produce. On this basis, the following incomplete budgeted income statement for the first year of activity is available:

Additional information on the new surfboard follows:

a. An investment of $1,500,000 will be necessary to carry inventories and accounts receivable and to purchase some new equipment. The company’s required rate of return is 18% on all investments.

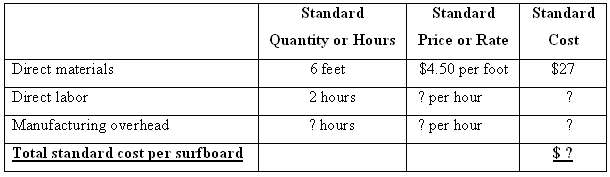

b. A partially completed standard cost card for the new surfboard follows:

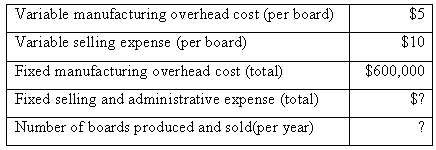

c. The company will employ 20 workers to make the new surfboards. Each will work a 40-hour week, 50 weeks a year.

d. Other information relating to production and costs follows:

e. Overhead costs are allocated to production on the basis of direct labor-hours.

Required;

1. Complete the standard cost card for a single surfboard.

2. Assume that the company uses the absorption costing approach to cost-plus pricing.

a. Compute the markup that the company needs on the surfboards to achieve an 18% return on investment (ROI).

b. Using the markup you have computed, prepare a price quotation sheet for a single surfboard.

c. Assume, as stated, that the company is able to sell all of the surfboards that it can produce. Complete the income statement for the first year of activity, and then compute the company’s ROI for the year. company’s ROI for the year.

3. Assuming that direct labor is a variable cost, how many units would the company have to sell at the price you computed in (2) above to achieve the T8% ROI? How many units would have to be sold to just break even?

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer