Challenge Problem (A computer spreadsheet software program or a financial calculator that can handle uneven cash flow

Question:

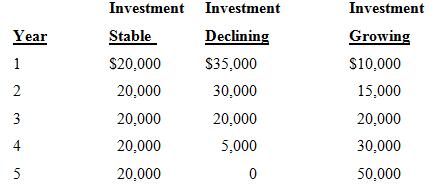

Challenge Problem (A computer spreadsheet software program or a financial calculator that can handle uneven cash flow streams will be needed to solve the following problems.) The following cash flow streams are expected to result from three investment opportunities.

a. Find the present values (PVs) at the end of time period zero for each of these three investments if the discount rate is 15 percent. Find the PVs for each investment using 10 percent and 20 percent discount rates.

b. Find the future values (FVs) of these three investments at the end of year five if the compound interest rate is 12.5 percent. Also find the future values for each investment using 2.5 percent and 22.5 percent compound rates.

c. Find the PVs of the three investments using a 15 percent annual discount rate but with quarterly discounting. Find the PVs for semi-annual and monthly discounting for a 15 percent stated annual rate.

d. Find the FVs of the three investments using a 12.5 percent annual compound rate but with quarterly compounding. Find the FVs for semi-annual and monthly compounding for a 12.5 percent stated annual rate.

e. Assume that the PV for each of the three investments is $75,000. What is the annual interest rate (%i) for each investment?

f. Show how your answers would change in (e) if quarterly discounting takes place.

g. Assume that the FV for each of the three investments is $150,000. What is the annual interest rate (%i) for each investment? [Note: (e) and (g) are independent of each other.]

h. Show how your answers would change in (g) if quarterly compounding takes place.

Because of more frequent than annual compounding and the complexities associated with uneven cash flows, we show results only for the “Stable” investment. The future value of the investment is $150,000, the period cash flow is $5000, and the number of periods is 20. This results in a compound rate of 4.0715% quarterly, or 16.29% (4.0715% x 4) annually.

Compound InterestCompound interest (or compounding interest) is interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan. Thought to have originated in 17th century Italy, compound... Compounding

Compounding is the process in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings over time. This growth, calculated using exponential functions, occurs because the investment will... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Future Value

Future value (FV) is the value of a current asset at a future date based on an assumed rate of growth. The future value (FV) is important to investors and financial planners as they use it to estimate how much an investment made today will be worth...

Step by Step Answer:

Introduction to Finance Markets Investments and Financial Management

ISBN: 978-1118492673

15th edition

Authors: Melicher Ronald, Norton Edgar