Chamberlain Canadian Imports has agreed to purchase 15,000 cases of Canadian beer for 4 million Canadian dollars

Question:

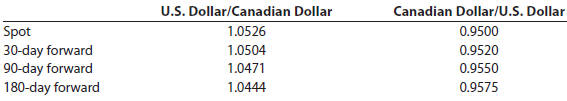

Chamberlain Canadian Imports has agreed to purchase 15,000 cases of Canadian beer for 4 million Canadian dollars at today’s spot rate. The firm’s financial manager, James Churchill, has noted the following current spot and forward rates:

On the same day, Churchill agrees to purchase 15,000 more cases of beer in 3 months at the same price of 4 million Canadian dollars.

a. What is the price of the beer in U.S. dollars if it is purchased at today’s spot rate?

b. What is the cost in U.S. dollars of the second 15,000 cases if payment is made in 90 days and the spot rate at that time equals today’s 90-day forward rate?

c. If the exchange rate for the Canadian dollar is 0.90 to $1 in 90 days, how much will Churchill have to pay for the beer (in U.S. dollars)?

Exchange RateThe value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston