Citation Builders, Inc. builds office buildings and single-family homes. The office buildings are constructed under contract with

Question:

Citation Builders, Inc. builds office buildings and single-family homes. The office buildings are constructed under contract with reputable buyers. The homes are constructed in developments ranging from 10–20 homes and are typically sold during construction or soon after. To secure the home upon completion, buyers must pay a deposit of 10% of the price of the home with the remaining balance due upon completion of the house and transfer of title. Failure to pay the full amount results in forfeiture of the down payment. Occasionally, homes remain unsold for as long as three months after construction. In these situations, sales price reductions are used to promote the sale.

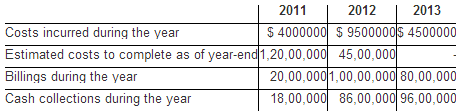

During 2011, Citation began construction of an office building for Altamont Corporation. The total contract price is $20 million. Costs incurred, estimated costs to complete at year-end, billings, and cash collections for the life of the contract are as follows:

Also during 2011, Citation began a development consisting of 12 identical homes. Citation estimated that each home will sell for $600,000, but individual sales prices are negotiated with buyers. Deposits were received for eight of the homes, three of which were completed during 2011 and paid for in full for $600,000 each by the buyers. The completed homes cost $450,000 each to construct. The construction costs incurred during 2011 for the nine uncompleted homes totaled $2,700,000.

Required:

1. Briefly explain the difference between the percentage-of-completion and the completed contract methods of accounting for long-term construction contracts.

2. Answer the following questions assuming that Citation uses the completed contract method for its office building contracts:

a. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2011 and 2012?

b. How much revenue related to this contract will Citation report in its 2011 and 2012 income statements?

c. What will Citation report in its December 31, 2011, balance sheet related to this contract (ignore cash)?

3. Answer requirements 2a–2c assuming that Citation uses the percentage-of-completion method for its office building contracts.

4. Assume that as of year end 2012, the estimated cost to complete the office building is $9,000,000 and that Citation uses the percentage-of-completion method.

a. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2012?

b. How much revenue related to this contract will Citation report in the 2012 income statement?

c. What will Citation report in its 2012 balance sheet related to this contract (ignore cash)?

5. When should Citation recognize revenue for the sale of its single-family homes?

6. What will Citation report in its 2011 income statement and 2011 balance sheet related to the single-family home business (ignore cash in the balance sheet)?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0077400163

6th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson