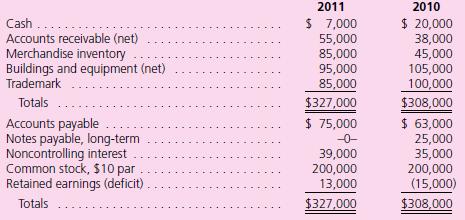

Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percentowned subsidiary Oakley Co. follow: Additional

Question:

Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent–owned subsidiary Oakley Co. follow:

Additional Information for Fiscal Year 2011

Additional Information for Fiscal Year 2011

• Iverson and Oakley’s consolidated net income was $45,000.

• Oakley paid $5,000 in dividends during the year. Iverson paid $12,000 in dividends.

• Oakley sold $11,000 worth of merchandise to Iverson during the year.

• There were no purchases or sales of long-term assets during the year.

In the 2011 consolidated statement of cash flows for Iverson Company:

Net cash flows from operating activities were

a. $12,000.

b. $20,000.

c. $24,000.

d. $25,000.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 978-0077431808

10th edition

Authors: Joe Hoyle, Thomas Schaefer, Timothy Doupnik

Question Posted: