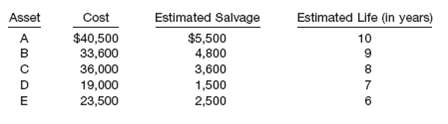

Composite Depreciation Presented below is information related to Morrow Manufacturing Corporation. (a) Compute the rate of Depreciation

Question:

Composite Depreciation Presented below is information related to Morrow Manufacturing Corporation.

(a) Compute the rate of Depreciation per year to be applied to the plant assets under the composite method.

(b) Prepare the adjusting entry necessary at the end of the year to record Depreciation for the year.

(c) Prepare the entry to record the sale of Asset D for cash of $5,000. It was used for 6 years, and Depreciation was entered under the composite method.

Depreciation is an important concept in accounting. By definition, depreciation is the wear and tear in the value of a noncurrent asset over its useful life. In simple words, depreciation is the cost of operating a noncurrent asset producing...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield

Question Posted: