(Comprehensive Problem: Issuance, Classification, Reporting) Presented below are four independent situations. (a) On March 1, 2011, Wilke...

Question:

(Comprehensive Problem: Issuance, Classification, Reporting) Presented below are four independent situations.

(a) On March 1, 2011, Wilke Co. issued at 103 plus accrued interest $4,000,000, 9% bonds. The bonds are dated January 1, 2011, and pay interest semiannually on July 1 and January 1. In addition, Wilke Co. incurred $27,000 of bond issuance costs. Compute the net amount of cash received by Wilke Co. as a result of the issuance of these bonds.

(b) On January 1, 2010, Langley Co. issued 9% bonds with a face value of $700,000 for $656,992 to yield 10%. The bonds are dated January 1, 2010, and pay interest annually. What amount is reported for interest expense in 2010 related to these bonds, assuming that Langley used the effective interest method for amortizing bond premium and discount?

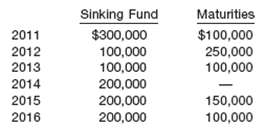

(c) Tweedie Building Co. has a number of long-term bonds outstanding at December 31, 2010. These long-term bonds have the following sinking fund requirements and maturities for the next 6 years. Indicate how this information should be reported in the financial statements at December 31, 2010.

(d) In the long-term debt structure of Beckford Inc., the following three bonds were reported: mortgage bonds payable $10,000,000; collateral trust bonds $5,000,000; bonds maturing in installments, secured by plant equipment $4,000,000. Determine the total amount, if any, of debenture bonds outstanding.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Bonds

When companies need to raise money, issuing bonds is one way to do it. A bond functions as a loan between an investor and a corporation. The investor agrees to give the corporation a specific amount of money for a specific period of time in exchange... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield