Consider a new video game developed by Dynamic Gaming, Inc. (DGI). DGIs development team was formed at

Question:

Consider a new video game developed by Dynamic Gaming, Inc. (DGI). DGI’s development team was formed at the end of 2009 and has been working on the development of the game for several years.

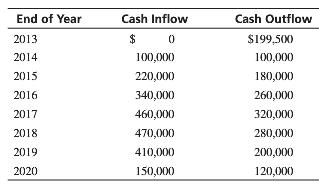

After spending $175,000 on the development, the team has reached the point in 2013 where it must make a decision on whether to proceed with production of the game. Production of the game will require an initial investment in facilities of $199,500 at the end of 2013. The project has an expected life cycle of 7 years (end of 2013 through 2020). Predicted cash flows for the game are as follows (assuming that all cash flows occur at the end of the year):

DGI’s applicable tax rate is 40%, and DGI uses straight-line depreciation over the asset’s expected life for tax purposes. The salvage value of the facilities will be zero in 7 years. DGI uses two criteria to evaluate potential investments: payback time and NPV. It wants a payback period of 3 years or less and an NPV greater than zero. DGI has a cost of capital of 18%.

1. Prepare a table that shows the after-tax annual net cash flows, cumulative net cash flow, and cumulative discounted net cash flow each year.

2. Would DGI invest in production of the game if it uses the payback period?

3. Would DGI invest in production of the game if it uses the NPV model?

4. Would you recommend that DGI invest in this project? Explain.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta