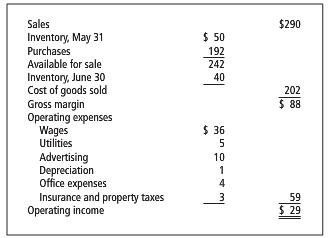

Consider the budgeted income statement for Carlson Company for June 20X4 in Exhibit 7-13. The cash balance,

Question:

Consider the budgeted income statement for Carlson Company for June 20X4 in Exhibit 7-13.

The cash balance, May 31, 20X4, is $15,000.

Sales proceeds are collected as follows: 80% the month of sale, 10% the second month, and 10% the third month.

Accounts receivable are $44,000 on May 31, 20X4, consisting of $20,000 from April sales and $24,000 from May sales.

Accounts payable on May 31, 20X4, are $145,000.

Carlson Company pays 25% of purchases during the month of purchase and the remainder during the following month.

All operating expenses requiring cash are paid during the month of recognition, except that insurance and property taxes are paid annually in December for the forthcoming year.

Prepare a cash budget for June. Confine your analysis to the given data. Ignore income taxes.

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta