Consider the SDE for the spot rate r t Suppose the parameters a, ?, ? are known,

Question:

Consider the SDE for the spot rate rt

Suppose the parameters a, ?, ? are known, and that as usual, Wt, is a Wiener process.

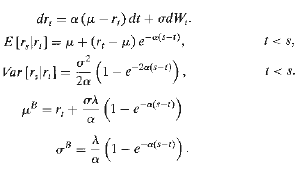

(a) Show that

(b) What do these two equations imply for the conditional mean and variance of spot rate as s ? ??

(c) Suppose the market price of interest rate risk is constant at ? (i.e., the Girsanov transformation adjusts the drift by ??). Using the bond price function given in (he text, show that the drift and diffusion parameter for a bond that matures at time s are given by

(d) What happens to bond price volatility as maturity approaches? IS this expected?

(e) What happens to the drill coefficient as maturity approaches? Is this expected?

(f) Finally, what is the drift and diffusion parameter for a bond with very long maturity, s ? ??

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

An Introduction to the Mathematics of financial Derivatives

ISBN: 978-0123846822

2nd Edition

Authors: Salih N. Neftci