Cool Sound Corporation manufactures a line of amplifiers that carry a three-year warranty against defects. Based on

Question:

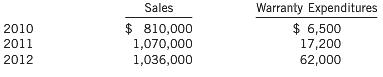

Cool Sound Corporation manufactures a line of amplifiers that carry a three-year warranty against defects. Based on experience, the estimated warranty costs related to dollar sales are as follows: first year after sale-2% of sales; second year after sale-3% of sales; and third year after sale-4% of sales. Sales and actual warranty expenditures for the first three years of business were:

Instructions

(a) Calculate the amount that Cool Sound Corporation should report as warranty expense on its 2012 income statement and as a warranty liability on its December 31, 2012 balance sheet. Assume that all sales are made evenly throughout each year and that warranty expenditures are also evenly spaced according to the rates above.

(b) Assume that Cool Sound's warranty expenditures in the first year after sale end up being 4% of sales, which is twice as much as was forecast. How would management account for this change?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470161012

9th Canadian Edition, Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield.