Cost allocation to divisions. Rembrandt Hotel & Casino is situated on beautiful Lake Tahoe in Nevada. The

Question:

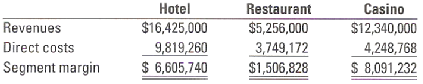

Cost allocation to divisions. Rembrandt Hotel & Casino is situated on beautiful Lake Tahoe in Nevada. The complex includes a 300-room hotel, a casino, and a restaurant. As Rembrandt’s new controller, cu are asked to recommend the basis to be used for allocating fixed overhead costs to the three divisions in 2008. You are presented with the following income statement information for 2008:

You are also given the following data on the three divisions:

You are told that you may choose to allocate indirect costs based on one of the following: direct costs, or square feet, or the number of employees. Total fixed overhead costs for 2008 was $14,550,000.

1. Calculate division margins in percentage terms prior to allocating fixed overhead costs.

2. Allocate indirect costs to the three divisions using each of the three allocation bases suggested. For each allocation base, calculate division operating margins after allocations in dollars and as a percentage of revenues.

3. Discuss the results. How would you decide how to allocate indirect costs to the divisions? Why?

4. Would you recommend closing any of the three divisions (and possibly reallocating resources to other divisions) as a result of your analysis? If so, which division would you close and why?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav