Cost distortions, original activity-based costs At its manufacturing plant in Duluth, Minnesota, Endo Electronics Company manufactures two

Question:

Cost distortions, original activity-based costs At its manufacturing plant in Duluth, Minnesota, Endo Electronics Company manufactures two products, X21 and Y37. For many years, the company has used a simple plantwide manufacturing support cost rate based on direct labor hours. A new plant accountant suggested that the company may be able to assign support costs to products more accurately by using an activity-based costing system that relies on a separate rate for each manufacturing activity that causes support costs.

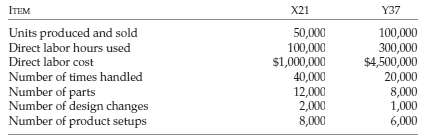

After studying the plant's manufacturing activities and costs, the plant accountant has collected the following data for last year:

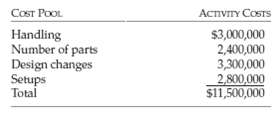

The accountant has also determined that actual manufacturing support costs incurred last year were as follows:

Required(a) Determine the unit cost of each product using direct labor hours to allocate all manufacturing support costs.(b) Determine the unit cost of each product using activity-based costing.(c) Which of the two methods from parts a and b produces more accurate estimates of job costs? Explain.(d) Suppose Endo has been determining its product prices by adding a 25% markup to its reported product cost. Compute the product prices on the basis of the costs computed in parts a and b. What do you recommend to Endo regarding its pricing?(e) What product-level changes do you suggest on the basis of the activity-based cost analysis? Who would be involved in bringing about your suggested changes?

Step by Step Answer:

Management Accounting Information for Decision-Making and Strategy Execution

ISBN: 978-0137024971

6th Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young