CVP analysis, income taxes ICMA, adapted) R. A. Go and Company, a manufacturer of quality handmade walnut

Question:

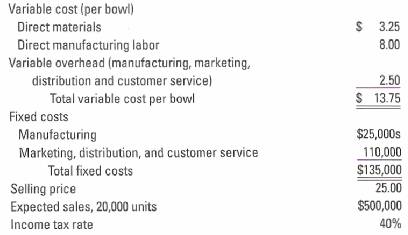

CVP analysis, income taxes ICMA, adapted) R. A. Go and Company, a manufacturer of quality handmade walnut bowls, has had a steady growth in sales for the past five years. However, increased competition has led Mr. Re, the president to believe that an aggressive marketing campaign will be necessary next year to maintain the company’s present growth. To prepare for next year’s marketing campaign the company’s controller has prepared and presented Mr. Go with the following data for the current year, 2008:

1. What is the projected net income for 2008?

2. What is the breakeven point in units for 2008?

3. Mr. Ro has set the revenue target for 2009 at a level of $550,000 (or 22,000 bowls). He believes an additional marketing cost of $11,250 for advertising in 2009, with all other costs remaining constant, will be necessary to attain the revenue target. What is the net income for 2009 if the additional $11,250 is spent and the revenue target is met?

4. What is the breakeven point in revenues for 2009 if the additional $11,250 is spent for advertising?

5. If the additional $11,250 is spent, what are the required 2009 revenues for 2009 net income to equal 2008 net income?

6. At a sales level of 22,000 units, what maximum amount can be spent on advertising if a 2009 net income of $60,000 is desired?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav