Danping Corporation, a calendar year taxpayer, sells lawn furniture through big box stores. It manufactures some of

Question:

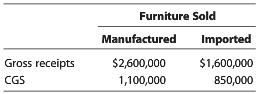

Danping Corporation, a calendar year taxpayer, sells lawn furniture through big box stores. It manufactures some of the furniture and imports some from unrelated foreign producers. For tax year 2015, Danping's records reveal the following information:

Danping also has selling and marketing expenses of $700,000 and administrative expenses of $300,000. Under the simplified deduction method, what is Danping’s:

a. DPGR?

b. QPAI?

c. DPAD?

Transcribed Image Text:

Furniture Sold Manufactured Imported Gross receipts $2,600,000 $1,600,000 850,000 CGS 1,100,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 68% (16 reviews)

a 2600000 DPGR cannot include gross receipts from the resale of imported goods b To determin...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

ISBN: 9781305399884

39th Edition

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young

Question Posted:

Students also viewed these Business Law questions

-

Purple Corporation, a calendar year taxpayer, began operations in 2012. It reported the following amounts for its first four tax years. Calculate Purples positive and negative ACE adjustments for...

-

Flicker Corporation, a calendar year taxpayer, manufactures yogurt that it wholesales to grocery stores and other food outlets. The company also operates a yogurt shop near its factory, where it...

-

Wabash Corporation, a calendar year taxpayer, purchases and places into service $400,000 of equipment in Year 1. The equipment is seven-year MACRS property, and the half-year convention applies to...

-

(a) Decide whether each of the following expressions are true or not. Answer yes or no. In any case where it is not true, provide the actual O-complexity. (i) log n = O(n!) (ii) 10! = O(log n) (iii)...

-

How are the Sampsons liquidity and investment decisions related?

-

Jump to level 1 A multimedia application allows users to create and edit their own songs and videos The customer owns the servers used in customer facilities. Which layers are managed by the...

-

A neutron star is an object with a mass of about \(1.4 M_{\odot}\), where the solar mass \(M_{\odot}=2 \times 10^{30}\) \(\mathrm{kg}\). The neutron star is aggregated to have density equal to that...

-

MSI is considering eliminating a product from its Toddle Town Tours collection. This collection is aimed at children one to three years of age and includes "tours" of a hypothetical town. Two...

-

Assume a hypothetical age that has not been assumed by other students. Assume you would like to invest in a zero-coupon bond in order to have $1000,000 in your retirement account when you get to the...

-

You are thinking of opening a small copy shop. It costs $5000 to rent a copier for a year, and it costs $0.03 per copy to operate the copier. Other fixed costs of running the store will amount to...

-

Citron Corporation has some domestic production gross receipts (DPGR) that qualify for the DPAD and some that do not. a. Is there a safe harbor that allows non-DPGR to be included in DPGR? b. Would...

-

Assume the same facts as in Problem 40, except that Danpings records do not identify its CGS (as between manufactured and imported furniture) but reflect an unallocated amount of $1,950,000. Further...

-

Discuss the advantages and disadvantages of using e-commerce in the procurement process.

-

In the Olympic shotput event, an athlete throws the shot with an initial speed of 13.0 m/s at a 46.0 angle from the horizontal. The shot leaves her hand at a height of 1.80 m above the ground. - Part...

-

On January 1, 2023, ABC Corporation acquired 100% of the outstanding common stock of XYZ Company for a purchase price of $10 million. The fair value of XYZ Company's identifiable net assets at the...

-

2) After lunch you and your friends decide to play a game of beach volleyball. a) You start the game by serving the ball at an angle of 25. If you are standing 4.2 m from the x value net and the ball...

-

Tyler has been working as a coffee barista for over ten years and has gained substantial knowledge of how the coffee industry works. He wants to open up his own shop and believes that he can drive...

-

During the first month of operations ended July 31, YoSan Inc. manufactured 2,400 flat panel televisions, of which 2,000 were sold. Operating data for the month are summarized as follows: Sales...

-

In Exercises 3 through 6, represent the given interval as a line segment on a number line. 1 < x < 5

-

Havel says the grocer doesnt believe what is on the sign and indeed, he says the grocers customers will barely notice it. But Havel maintains that the sign serves a specific function. How would you...

-

Did Goldman have a fiduciary duty to eToys? Did it violate this duty? Goldman Sachs was the lead underwriter for eToys initial public offering. In the IPO, eToys agreed to sell 8,320,000 shares of...

-

Is someone who aids and abets a violation of Section 10(b) liable under the statute? Charter Communications, Inc., a cable operator, engaged in a variety of fraudulent practices to pump up its...

-

David Sokol worked at Berkshire Hathaway for legendary investor Warren Buffett, who is renowned not only for his investment skills but also his ethics. Bankers suggested to both Sokol and the CEO of...

-

Explain why leasing is an option for a company expansion. include, what leasing is and how it will benefit the company in it's expanding efforts. Also, how is capital or operating leasing recorded on...

-

Discuss the following statement: " A head of state signs a treaty on behalf of his country in excess of authority of his country, such treaty shal be void for inconsistency with domestic law of the...

-

A company is looking at new equipment with an installed cost of $415,329. This cost will be depreciated straight-line to zero over the project's 5-year life, at the end of which the equipment can be...

Study smarter with the SolutionInn App