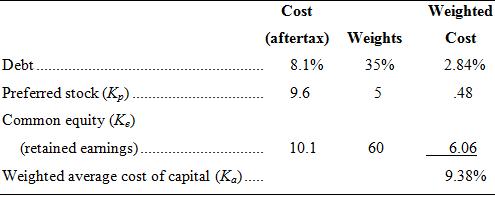

Delta Corporation has the following capital structure: a. If the firm has $18 million in retained earnings,

Question:

Delta Corporation has the following capital structure:

a. If the firm has $18 million in retained earnings, at what size capital structure will the firm run out of retained earnings?

b. The 8.1 percent cost of debt referred to earlier applies only to the first $14 million of debt. After that, the cost of debt will go up. At what size capital structure will there be a change in the cost of debt?

Capital StructureCapital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Cost Of Debt

The cost of debt is the effective interest rate a company pays on its debts. It’s the cost of debt, such as bonds and loans, among others. The cost of debt often refers to before-tax cost of debt, which is the company's cost of debt before taking...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259194078

15th edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

Question Posted: