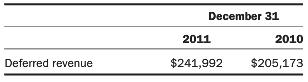

Diebold, Incorporated, a manufacturer of automated teller machines, showed the following current liability on the balance sheet

Question:

Diebold, Incorporated, a manufacturer of automated teller machines, showed the following current liability on the balance sheet on December 31, 2011 ($ amounts in thousands):

The footnotes to the financial statements stated the following: “Deferred revenue is recorded for any services billed to customers in advance of the contract period commencing.” Assume that service contracts typically cover a 12-month period and can begin at any given month during the year. Revenue is recognized ratably over the life of the contract period. (“Recognized ratably” means an equal amount per month.)

1. Prepare summary journal entries for the creation in 2010, and subsequent earning in 2011, of the deferred revenue of $205,173. Use the following accounts: Accounts Receivable, Deferred Revenue, and Income from Advance Billings.

2. A 1-year job contract was billed to Keystone Bank on January 1, 2011, for $36,000. Work began on January 2. The full amount was collected on February 15. Prepare all pertinent journal entries through February 28, 2011. Use the following accounts: Accounts Receivable Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Introduction to Financial Accounting

ISBN: 978-0133251036

11th edition

Authors: Charles Horngren, Gary Sundem, John Elliott, Donna Philbrick