Doctors Mowtain, Lawrence, and Curley are radiologists living in Yukville, Maine. They realize that many of the

Question:

Doctors Mowtain, Lawrence, and Curley are radiologists living in Yukville, Maine. They realize that many of the state’s small, rural hospitals cannot afford to purchase their own magnetic resonance imaging devices (MRIs). The doctors are considering whether it would be feasible for them to form a corporation and invest in their own MRI unit. The unit would be transported on a scheduled basis to more than 80 rural hospitals using an 18-wheel tractor-trailer. The cost of a tractor-trailer equipped with MRI equipment is approximately $1,500,000. The estimated life of the investment is nine years, after which time its salvage value is expected to be no more than $200,000.

The doctors anticipate that the investment will generate incremental revenue of $900,000 per year. Incremental expenses (which include depreciation, insurance, fuel, maintenance, their salaries, and income taxes) will average $800,000 per year. Net incremental cash flows will be reinvested back into the corporation. The only difference between incremental cash flows and incremental income is attributable to depreciation expense. The doctors require a minimum return on their investment of 15 percent.

Instructions

a. Compute the payback period of the mobile MRI proposal.

b. Compute the return on average investment of the proposal.

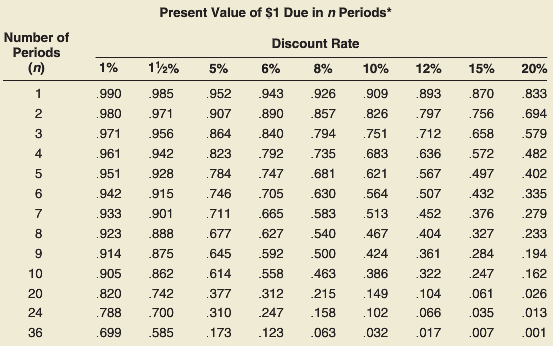

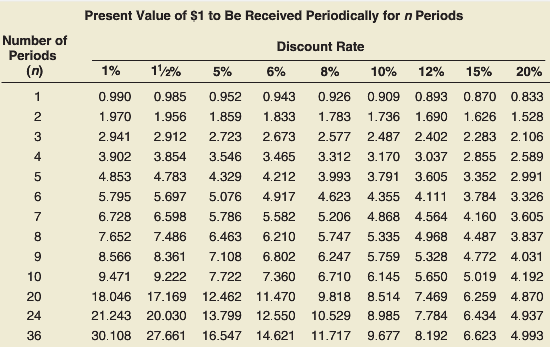

c. Compute the net present value of the proposal using the tables in Exhibits 26–3 and 26–4. Comment on what the actual rate of return might be.

d. What nonfinancial factors should the doctors consider in making this decision?

In Exhibits 26–3

In Exhibits 26–4

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-0078111044

16th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello