Dollin Inc. is incorporated under Virginia law and has its corporate headquarters in Richmond. Dollin is a

Question:

Dollin Inc. is incorporated under Virginia law and has its corporate headquarters in Richmond. Dollin is a distributor; it purchases tangible goods from manufacturers and sells the goods to retailers. It has a branch office through which it sells goods in the United Kingdom and owns 100 percent of a French corporation (French Dollin) through which it sells goods in France. Dollin’s financial records provide the following information for the year:

Before-tax net income from sales:

Domestic sales $ 967,900

UK sales (foreign source income) …………… 415,000

$1,382,900

Dividend income: Brio Inc. ………………….. $ 8,400

French Dollin (foreign source income) ……… 33,800

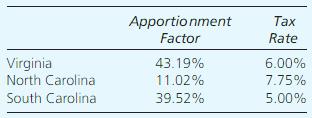

• Dollin pays state income tax in Virginia, North Carolina, and South Carolina. All three states tax their apportioned share of Dollin’s net income from world-wide sales. Because Virginia is Dollin’s commercial domicile, it also taxes Dollin’s U.S. source (but not foreign source) dividend income net of any federal dividends-received deduction. The states have the following apportionment factors and tax rates:

• Dollin paid $149,200 income tax to the United Kingdom.

• Brio Inc. is a taxable U.S. corporation. Dollin owns 2.8 percent of Brio’s stock.

• The $33,800 dividend from French Dollin is a distribution of after-tax earnings with respect to which French Dollin paid $17,000 French income tax.

• Dollin elects to claim the foreign tax credit rather than to deduct foreign income taxes. Solely on the basis of the above facts, compute the following:

a. Dollin’s state income tax for Virginia, North Carolina, and South Carolina.

b. Dollin’s federal income tax. Assume that Dollin paid the state taxes during the year, and no state income tax is allocable to foreign source income.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Principles Of Taxation For Business And Investment Planning 2016 Edition

ISBN: 9781259549250

19th Edition

Authors: Sally Jones, Shelley Rhoades Catanach