Duffy and Rowe is a full-service legal firm. During the year, corporate clients required 5,000 hours of

Question:

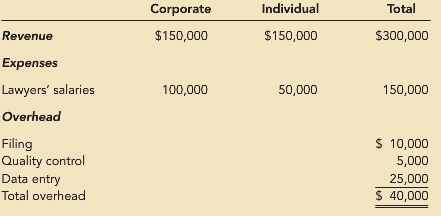

Duffy and Rowe is a full-service legal firm. During the year, corporate clients required 5,000 hours of legal services, whereas individuals required 3,000 hours. In the past, the firm has assigned overhead to client engagements based on direct labor hours. However, Duffy suspects that legal services to corporate clients drive firm overhead more than legal services to individuals and believes that adopting activity-based costing will allow a more accurate allocation of cost to various clients. The firm’s revenues and costs for the year are as follows:

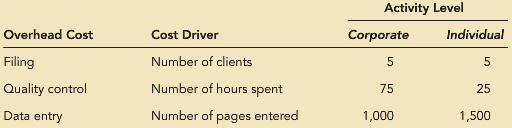

Rowe has kept records of the following data for use in the new activity-based costing system:

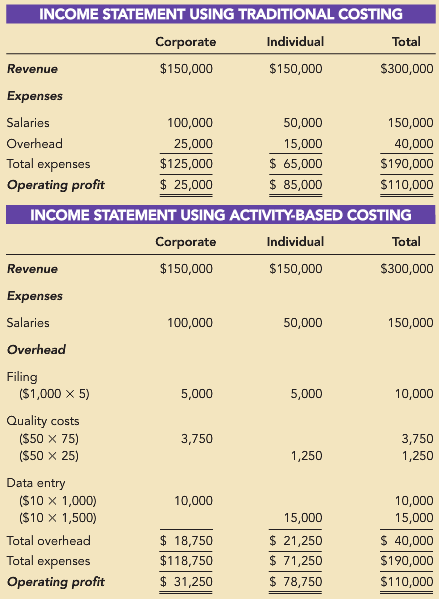

The accounting manager has prepared the following pro forma income statements:

Required

Calculate the overhead rate for individual and corporate clients for the traditional income statement. Compare those rates to the rates for the activity-based costing income statement. Discuss the best way to allocate costs in this example, and include the approximate difference in profits between corporate and individual clients. Why would activity-based costing be preferred as a cost allocation method?

Step by Step Answer:

Managerial Accounting A Focus on Ethical Decision Making

ISBN: 978-0324663853

5th edition

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins