During the year, cost of goods sold was $80,000; income from operations was $76,000; income tax expense

Question:

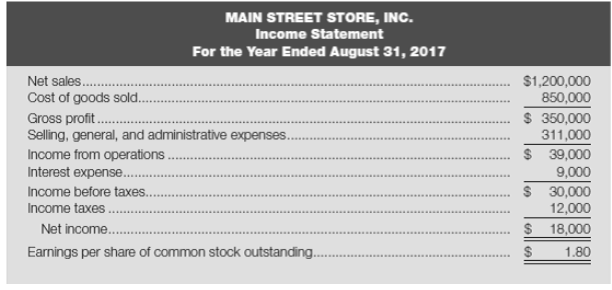

During the year, cost of goods sold was $80,000; income from operations was $76,000; income tax expense was $16,000; interest expense was $12,000; and selling, general, and administrative expenses were $44,000.

Required:

Calculate net sales, gross profit, income before taxes, and net income. (Exhibit 2-2 may he used as a solution model.)

Exhibit 2-2

Transcribed Image Text:

MAIN STREET STORE, INC. Income Statement For the Year Ended August 31, 2017 $1,200,000 850,000 Net sales. Cost of goods sold. $ 350,000 311,000 Gross profit. Selling, general, and administrative expenses. $ 39,000 9,000 Income from operations. Interest expense.. $ 30,000 12,000 Income before taxes... Income taxes. Net income... Earnings per share of common stock outstanding. $ 18,000 2$ 1.80

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 76% (13 reviews)

Set up an income statement using the structure and format as shown i...View the full answer

Answered By

Sinmon Warui Kamau

After moving up and down looking for a job, a friend introduced me to freelance writing. I started with content writing and later navigated to academic writing. I love writing because apart from making a living out of it, it is also a method of learning and helping others to learn.

5.00+

40+ Reviews

45+ Question Solved

Related Book For

Accounting What the Numbers Mean

ISBN: 978-1259535314

11th edition

Authors: David Marshall, Wayne McManus, Daniel Viele

Question Posted:

Students also viewed these Cost Accounting questions

-

During the year, cost of goods sold was $40,000; income from operations was $38,000; income tax expense was $8,000; interest expense was $6,000; and selling, general, and administrative expenses were...

-

During the year, net sales were $125,000; gross profit was $50,000; net income was $20,000; income tax expense was $5,000; and selling, general, and administrative expenses were $22,000. Required:...

-

Selling, general, and administrative expenses were $132,000; net sales were $600,000; interest expense was $14,200; research and development expenses were $63,000; net cash provided by operating...

-

Given: MIII; Prove: M Use the definitions and postulates given in Example 2 to prove the theorems in Problems 914. Give both statements and reasons.

-

On January 1, 2002, the Key West Company acquired a pie-making machine for $50,000. The machine was expected to have a useful life of 10 years with no residual value. Key West uses the straight-line...

-

Of the bolts manufactured for a certain application, 90% meet the length specification and can be used immediately, 6% are too long and can be used after being cut, and 4% are too short and must be...

-

The horizontal beam is assumed to be rigid and supports the distributed load shown. Determine the vertical reactions at the supports. Each support consists of a wooden post having a diameter of 120...

-

During January 2011, Pentagon Company purchased 12,000 shares of the 200,000 outstanding common shares (no-par value) of Square Corporation at $25 per share. This block of stock was purchased as a...

-

Managing finances is essential for any business, big or small. It involves careful planning and allocation of resources to achieve goals. Budgeting is crucial as it helps firms manage their cash...

-

1. Create and upload a histogram of the salary data for the city of Bell, where each bar width is about 50,000 US dollars. (Data for the histogram is at the bottom). a.) Is the distribution of the...

-

During the year, net sales were $250,000; gross profit was $100,000; net income was $40,000; income tax expense was $10,000; and selling, general, and administrative expenses were $44,000. Required:...

-

The information presented here represents selected data from the December 31, 2016, balance sheets and income statements for the year then ended for three firms: Required: Calculate the missing...

-

A home-equity loan involves borrowing against the equity in a house. For example, if your house is valued at $250,000 and you have been paying the mortgage for a sufficient amount of time, you may...

-

Goal is to have a html webpage with SQL, linked by PHP. I am trying to figure out how to link my database to the website. The website will have the choice to buy an apple or an orange, then also ask...

-

What is the three problem faced by the Commercial Bank of Qatar? with explain each point of problem Explain the Corporate and Competitive Strategic of Commercial Bank of Qatar based on SWOT Analysis...

-

1. Make a HTML form to ask the user for their name and their favorite ice cream flavor (from a list of 4 flavors provided by you in a drop down menu) 2. Format the page as you see fit. *Can be simple...

-

In a perfectly competitive deposit market, each bank decides how many deposits to issue taking the market deposit rate as "given." Consider each part below, explain briefly and write words and...

-

What is the hybridization at the indicated atom in the molecules and ions listed below? Use a wedge-dash drawing, if appropriate, and show all lone pairs for the molecule/ion to get credit. Assume...

-

Hertz and other car rental companies charge much more to rent luxury cars such as Ferraris and Bentleys than to rent compact cars such as the Toyota Yaris or Chevrolet Sonic. Is this price...

-

A sample statistic will not change from sample to sample. Determine whether the statement is true or false. If it is false, rewrite it as a true statement.

-

Assume that you own 14,000 shares of Briant Inc.s common stock and that you currently receive cash dividends of $1.68 per share per year. Required: a. If Briant Inc. declared a 5% stock dividend, how...

-

Dedrick Inc. did not pay dividends in 2018 or 2019, even though 60,000 shares of its 7.5%, $50 par value cumulative preferred stock were outstanding during those years. The company has 900,000 shares...

-

Rosie Inc. did not pay dividends on its $4.50, $50 par value, cumulative preferred stock during 2018 or 2019, but had met its preferred dividend requirement in all prior years. Since 2014, 42,000...

-

Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Submit Date March 1 March 5 March 9 March 18 March 25 March 29...

-

Wilmington Company has two manufacturing departments-Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is...

-

What are the fundamental differences between preemptive and cooperative multitasking in an operating system, and in which scenarios would each be most effective ?

Study smarter with the SolutionInn App