Each of the following situations is independent a. Make or Buy Terry Inc. manufactures machine parts for

Question:

Each of the following situations is independent

a. Make or Buy Terry Inc. manufactures machine parts for aircraft engines. CEO Bucky Walters is considering an offer from a subcontractor to provide 2,000 units of product OP89 for $120,000. If Terry does not purchase these parts from the subcontractor, it must continue to produce them in-house with these costs:

Costs per Unit

Direct materials …………………………. $28

Direct labor ……………………………....… 18

Variable overhead ………………………. 16

Fixed overhead ………………………....….. 4

Required

Should Terry Inc. accept the offer from the subcontractor? Why or why not?

b. Disposal of Assets A company has an inventory of 2,000 different parts for a line of cars that has been discontinued. The net book value of inventory in the accounting records is $50,000. The parts can be either remachined at a total additional cost of $25,000 and then sold for $30,000 or sold as is for $2,500. What should it do?

c. Replacement of Asset An uninsured boat costing $90,000 was wrecked the first day it was used. It can be either sold as is for $9,000 cash and replaced with a similar boat costing $92,000 or rebuilt for $75,000 and be brand new as far as operating characteristics and looks are concerned. What should be done?

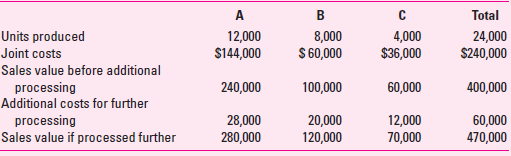

d. Profit from Processing Further Deaton Corporation manufactures products A, B, and C from a joint process. Joint costs are allocated on the basis of relative sales value at the end of the joint process.

Additional information for Deaton Corporation follows:

Required

Which, if any, of products A, B, and C should be processed further and then sold?

e. Make or Buy Eggers Company needs 20,000 units of a part to use in producing one of its products. If Eggers buys the part from McMillan Company for $90 instead of making it, Eggers could not use the released facilities in another manufacturing activity. Fifty percent of the fixed overhead will continue irrespective of CEO Donald Mickey’s decision. The cost data are

Cost to make the part

Direct materials …………………… $35

Direct labor ……………………….. 16

Variable overhead ………………… 24

Fixed overhead …………………… 20

$95

Required

Determine which alternative is more attractive to Eggers and by what amount.

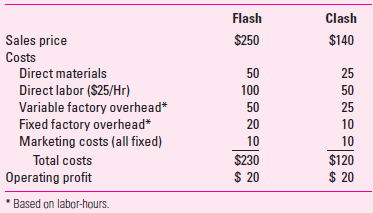

f. Selection of the Most Profitable Product DVD Production Company produces two basic types of video games, Flash and Clash. Pertinent data for DVD Production Company follows:

The DVD game craze is at its height so that either Flash or Clash alone can be sold to keep the plant operating at full capacity. However, labor capacity in the plant is insufficient to meet the combined demand for both games. Flash and Clash are processed through the same production departments.

Required

Which product should be produced? Briefly explain your answer.

g. Special Order Pricing Barry’s Bar-B-Que is a popular lunch-time spot. Barry is conscientious about the quality of his meals, and he has a regular crowd of 600 patrons for his $5 lunch. His variable cost for each meal is about $2, and he figures his fixed costs, on a daily basis, at about $1,200. From time to time, bus tour groups with 50 patrons stop by. He has welcomed them since he has capacity to seat 700 diners in the average lunch period, and his cooking and wait staff can easily handle the additional load. The tour operator generally pays for the entire group on a single check to save the wait staff and cashier the additional time. Due to competitive conditions in the tour business, the operator is now asking Barry to lower the price to $3.50 per meal for each of the 50 bus tour members.

Required

Should Barry accept the $3.50 price? Why or why not? What if the tour company were willing to guarantee 200 patrons (or four bus loads) at least once a month for $3.00 per meal?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Cost management a strategic approach

ISBN: 978-0073526942

5th edition

Authors: Edward J. Blocher, David E. Stout, Gary Cokins