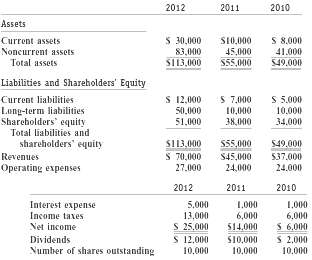

Edgemont Repairs began operations on January 1, 2010. The 2010, 2011, and 2012 financial statements follow: On

Question:

Edgemont Repairs began operations on January 1, 2010. The 2010, 2011, and 2012 financial statements follow:

On January 1, 2012, the company expanded operations by taking out a $40,000 long-term loan at a 10 percent annual interest rate.

REQUIRED:a. Compute return on equity, return on assets, common equity leverage, capital structure leverage, profit margin and asset turnover.b. On January 1, 2012, the company's common stock was selling for $20 per share. Assume that Edgemont issued 2,000 shares of stock instead of borrowing the $40,000, to raise the cash needed to pay for the January 1 expansion. Re-compute the ratios in (1) for 2012. Ignore any tax effects.c. Should the company have issued the equity instead of borrowing the funds?Explain.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Capital Structure

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a...

Step by Step Answer: