EPS, PE, and Mergers The shareholders of Flannery Company have voted in favor of a buyout offer

Question:

EPS, PE, and Mergers The shareholders of Flannery Company have voted in favor of a buyout offer from Stultz Corporation. Information about each firm is given here:

Flannery's shareholders will receive one share of Stultz stock for every three shares they hold in Flannery.

a. What will the EPS of Stultz be after the merger? What will the PE ratio be if the NPV of the acquisition is zero?

b. What must Stultz feel is the value of the synergy between these two firms? Explain how your answer can be reconciled with the decision to go ahead with the takeover.

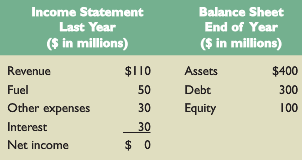

Income Statement Balance Sheet Last Year End of Year ($ in millions) ($ in millions) Revenue $110 Assets $400 Fuel 50 Debt 300 Other expenses 30 Equity 100 Interest 30 Net income

Step by Step Answer:

a The EPS of the combined company will be the sum of the earnings of both companies divided by the s...View the full answer

Corporate Finance

ISBN: 978-0077861759

10th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Corporate Finance questions

-

The shareholders of Flannery Company have voted in favor of a buyout offer from Stultz Corporation. Information about each firm is given here: ..............................................Flannery...

-

The shareholders of Flannery Company have voted in favor of a buyout offer from Stultz Corporation. Information about each firm is given here: Flannerys shareholders will receive one share of Stultz...

-

The shareholders of Jolie Company have voted in favor of a buyout offer from Pitt Corporation. Information about each firm is given here: Jolie Pitt Price-earnings...

-

Suppose a town concludes that it costs on average $30.00 per household to manage the disposal of the waste generated by households each year. It is debating two strategies for funding this cost: (1)...

-

(a) Describe briefly three major differences between: (i) Financial accounting, and (ii) Cost and management accounting. (b) Below are incomplete cost accounts for a period The balances at the end of...

-

Job security, health security, and so on come under: Security needs Social needs Esteem needs Self-actualization

-

An electromagnet in a physics laboratory is damaging electronic apparatus in its vicinity. You suspect that the damage is due to unusually large induced currents created each time the electromagnet...

-

On January 1, 2014, Mechanics Credit Union (MCU) issued 7%, 20-year bonds payable with face value of $ 300,000. The bonds pay interest on June 30 and December 31. Requirements 1. If the market...

-

which muscle were use to extend and splay your finger outward?

-

Chicken feed is transported by trucks from three silos to four farms. Some of the silos cannot ship directly to some of the farms. The capacities of the other routes are limited by the number of...

-

Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total aftertax annual cash flow by $1.1 million...

-

Cholern Electric Company (CEC) is a public utility that provides electricity to the central Colorado area. Recent events at its Mile-High Nuclear Station have been discouraging. Several shareholders...

-

Define the terms sufficient appropriate audit evidence and audit program. Discuss how these two terms relate to one another.

-

Given the function f(x) = 7x + 10 x < 0 7x+20 x > 0 Calculate the following values: f(-1) = f(0) = f(2) =

-

Julie Smith is the principal of Frederick High School in Winchester, VA. During the first full week of fall-semester, the Frederick County Sheriffs Department conducts an Active Shooter Emergency...

-

What was Thomas Malthuss theory? what it has impact on growth ?

-

The shaft shown in the figure is supported on bearings located at A and D. The shaft is made from steel with a yield strength of 400 MPa and an ultimate strength of 600 MPa. The shaft has a machined...

-

Complete the table to determine the amount of money P that: at rate 6% to produce a final balance of $100,000 in t years. t 1 P 10 20 30 40 50

-

A gas is to be cooled from 100C to 45C using cooling water that enters the heat exchanger at 30C and leaves at 40C. What is the LMTD for the heat exchanger if the flow of the streams is 1....

-

Ashlee, Hiroki, Kate, and Albee LLC each own a 25 percent interest in Tally Industries LLC, which generates annual gross receipts of over $10 million. Ashlee, Hiroki, and Kate manage the business,...

-

Why does a real option add value to an investment decision?

-

The Dybvig Corporation's common stock has a beta of 1.17. If the risk-free rate is 3.8 percent and the expected return on the market is 11 percent, what is Dybvig's cost of equity capital?

-

Kose, Inc., has a target debt-equity ratio of .45. Its WACC is 9.8 percent, and the tax rate is 35 percent. a. If Kose's cost of equity is 13 percent, what is its pretax cost of debt? b. If instead...

-

Given the following information for Huntington Power Co., find the WACC. Assume the company's tax rate is 35 percent. Debt: 10,000 5.6 percent coupon bonds outstanding, $1,000 par value, 25 years to...

-

Solve (2.4 x 10-5) X 875 (2.5 x 107) x (2.8 x 107)

-

assume there are no outliers. Draw the boxplot for the following frequency table. You may X f rf cf crf 3 7 0.1228 7 0.1228 4 11 0.1930 18 0.3158 5 9 0.1579 27 0.4737 618 6 0.1053 33 0.5789 10 0.1754...

-

Find the partial derivative of the regularized least squares problem: {) (w + x) (wo + w x ( ) + w x ( ) } + |/\||[w1, w2]|| with respect to wo, w, and w2. Although there is a closed-form solution to...

Study smarter with the SolutionInn App