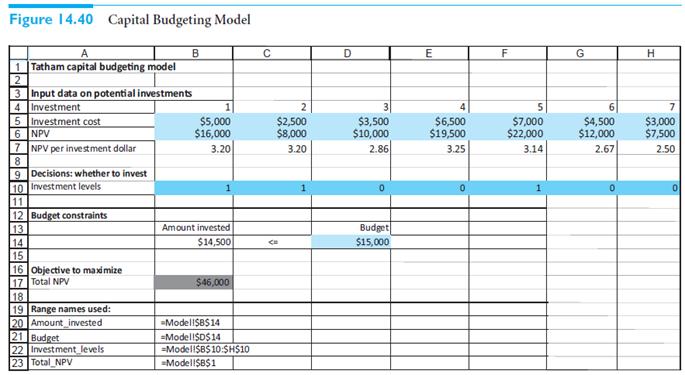

Expand the capital budgeting model in Figure 14.40 so that there are now 20 possible investments. You

Question:

The cash requirements and NPVs for the various investments can vary widely, but the ratio of NPV to cash requirement should be between 2.5 and 3.5 for each investment. The budget should allow somewhere between 5 and 10 of the investments to be selected.

Capital Budgeting

Capital Budgeting

Capital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Data Analysis and Decision Making

ISBN: 978-0538476126

4th edition

Authors: Christian Albright, Wayne Winston, Christopher Zappe

Question Posted: