Financial statements for Pad Corporation and its 75 percent-owned subsidiary, Sum Corporation, for 2011 are summarized as

Question:

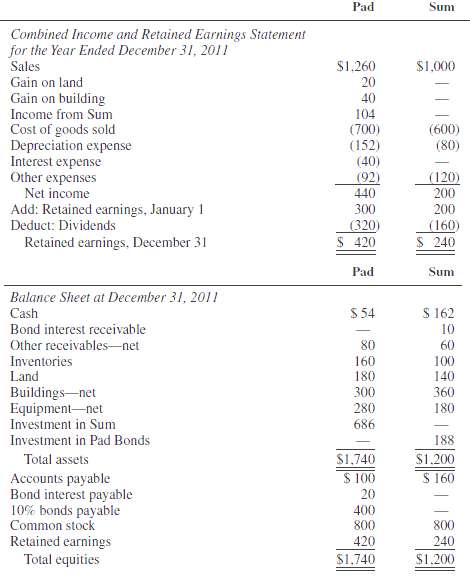

Financial statements for Pad Corporation and its 75 percent-owned subsidiary, Sum Corporation, for 2011 are summarized as follows (in thousands):

Pad acquired its interest in Sum at book value during 2008, when the fair values of Sum's assets and liabilities were equal to their recorded book values.ADDITIONAL INFORMATION1. Pad uses the equity method for its investment in Sum.2. Intercompany merchandise sales totalled $100,000 during 2011. All intercompany balances have been paid except for $20,000 in transit at December 31, 2011.3. Unrealized profits in Sum's inventory of merchandise purchased from Pad were $24,000 on December 31, 2010, and $30,000 on December 31, 2011.4. Sum sold equipment with a six-year remaining life to Pad on January 3, 2009, at a gain of $48,000. Pad still uses the equipment in its operations.5. Pad sold land to Sum on July 1, 2011, at a gain of $20,000.6. Pad sold a building to Sum on July 1, 2011, at a gain of $40,000. The building has a 10-year remaining life and is still used by Sum.7. Sum purchased $200,000 par value of Pad's 10 percent bonds in the open market for $188,000 plus $10,000 accrued interest on December 31, 2011. Interest is paid semiannually on January 1 and July 1. The bonds mature on December 31, 2016.REQUIRED: Prepare consolidation workpapers for Pad Corporation and Subsidiary for the year ended December 31,2011.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith