A firm is considering two alternatives: At the end of 4 years, another B may be purchased

Question:

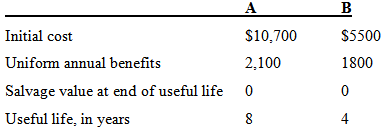

A firm is considering two alternatives:

At the end of 4 years, another B may be purchased with the same cost, benefits, and so forth. If the MARR is 10%, which alternative should be selected?

MARRMinimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Transcribed Image Text:

A Initial cost Uniform annual benefits $10,700 $5500 2,100 1800 Salvage value at end of useful life Useful life, in years 4

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (14 reviews)

Since ROR AB MARR the increment ...View the full answer

Answered By

Srinivas Vangapally

I have done my masters degree in computers applications from Osmania university in 2010. I have been working as a high school Mathematics Teacher. I have 9 years of experience in teaching

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Economics questions

-

A firm is considering two projects. Both have an initial investment of $1,000,000 and pay off over the next five years in this fashion. The cost of capital is 6%. a. Which of these has a faster...

-

A nonprofit government corporation is considering two alternatives for generating | power: Alternative A. Build a coal-powered generating [facility at a cost of $20,000,000. Annual power sales are...

-

A firm is considering two mutually exclusive projects, as follows. Determine which project should be accepted if the discount rate is 15 percent. Use the chain replication approach. Assume both...

-

Parker Associates purchased a patent in 2018 for $200,000. The patent will be amortized over 20 years. How would Parker adjust for the annual amortization for the patent on the balance sheet? Credit...

-

1. The graph of a polynomial function is ________, which means that the graph has no breaks, holes, or gaps. 2. The ________ ________ ________ is used to determine the left-hand and right-hand...

-

Montana Company signs a five-year capital lease with Elway Company for office equipment. The annual lease payment is $20,000, and the interest rate is 8%. Required 1. Compute the present value of...

-

The following data were obtained for the velocity profiles in turbulent flow at a specified point in a channel flow as a function of time. The measurements were taken 0.01 seconds apart. The velocity...

-

Your firm is contemplating the purchase of a new $410,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $30,000 at...

-

Carmen Camry operates a consulting firm called Help Today, which began operations on December 1. On December 31, the company's records show the following selected accounts and amounts for the month...

-

You decide to sell short 100 shares of Charlotte Horse Farms when it is selling at its yearly high of $56. Your broker tells you that your margin requirement is 45 percent and that the commission on...

-

Consider the three alternatives: Which alternative should be selected? (a) If MARR =6%? (b) If MARR =8%? (c) If MARR = 10%? Do Nothing Year A -$100 -$150 +30 +43 +43 2 +30 +30 +43 +43 4 +30 +30 +43

-

Consider the following alternatives: Initial cost Uniform annual benefits Each alternative has a l0-year useful life and no salvage value . If the MARR is 8%, which alternative should be selected? A...

-

You, a CA, have recently accepted a job at the accounting firm of Cat, Scan, & Partners, as a manager, and have been assigned the audit of Vision Clothing Inc. (VCI). The partner in charge had been...

-

Helping Hospital operates a general hospital but rents space to separately owned entity to Pec Helping Hospital charges Pediatrics for patients' services. Helping Hospital charged the following costs...

-

2 Riscko debtor schedule as at 31 May 20XX correction task You are Joan Jacks and you are an Accountant who works for Riskco, a reputable risk management consultancy company. You are checking the...

-

Current Attempt in Progress * Only those costs that differ across alternatives, i.e., relevant costs are to be considered. In incremental analysis, the only costs to be considered are variable costs....

-

Think about your core customers, whether internal or external, and identify at least 2 key customer segments.For each of your identified customer segments, address the following: Describe each...

-

Joe is a mechanic by trade who operates high-performance racing vehicles. He is passionate about his craft and has been in the industry for over 30 years. He owns his own home on acreage with his...

-

(LO2) Sasha owns eight profitable rental properties and would like to shift some of this income to her children, Darius, age 17, and Delilah, age 11. Darius would be responsible for yard maintenance,...

-

Highland Theatre is owned by Finnean Ferguson. At June 30, 2014, the ledger showed the following: Cash, $6,000; Land, $100,000; Buildings, $80,000; Equipment, $25,000; Accounts Payable, $5,000;...

-

Use the guidelines of this section to sketch the curve. In guideline D find an equation of the slant asymptote. y = (x + 1) 3 /(x 1) 2 Data from section 4.5 GUIDELINES FOR SKETCHING A CURVE The...

-

The DNA Corporation, a biotech engineering firm, has identified seven R&D projects for funding. Each project is expected to be in the R&D stage for three to five years. The IRR figures shown in Table...

-

Gene Fowler owns a house that contains 202 square feet of windows and 40 square feet of doors. Electricity usage totals 46,502 kWh: 7.960 kWh for lighting and appliances; 5,500 kWh for water heating:...

-

Consider a project whose initial investment is $500,000 financed at an interest rate of 9% per year. Assuming that the required repayment period is six years, determine the repayment schedule by...

-

Milden Company is a merchandiser that plans to sell 4 1 , 0 0 0 units during the next quarter at a selling price of $ 5 9 per unit. The company also gathered the following cost estimates for the next...

-

How do organizational learning theories, such as the learning organization concept and knowledge management practices, contribute to sustained competitive advantage and organizational resilience in...

-

Harbert, Incorporated had a beginning balance of $12,000 in its Accounts Receivable account. The ending balance of Accounts Receivable was $10,500. During the period, Harbert collects $72,000 of its...

Study smarter with the SolutionInn App