Fodhia Inc. (Fodhia) is a small manufacturing company operating in eastern Canada. Fodhia is a public company.

Question:

Fodhia Inc. (Fodhia) is a small manufacturing company operating in eastern Canada. Fodhia is a public company.

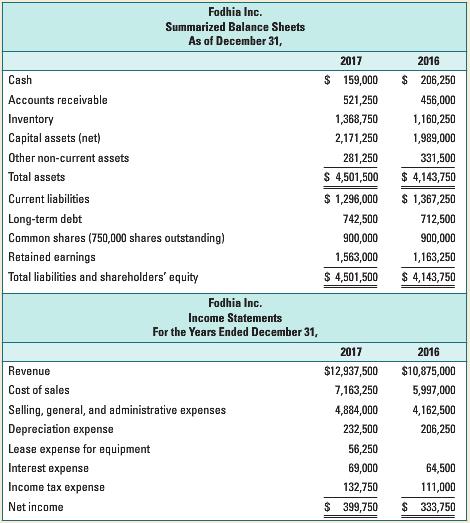

In 2016, Fodhia's management decided to acquire additional manufacturing equip ment to be able to meet the increasing demand for its products. However, instead of purchasing the equipment, Fodhia arranged to lease it. The lease came into effect on January 1, 2017. In its 2017 financial statements Fodhia accounted for the leases as operating leases. You have obtained Fodhia's summarized balance sheets and income statements for 2016 and 2017.

Had Fodhia accounted for the equipment leases as capital leases, the following differences would have occurred in the 2017 financial statements:

• No lease expense would have been recorded.

• The leased equipment would have been recorded on the balance sheet as capital assets for $345,000. The equipment would have been depreciated straight line over 12 years.

• A liability of $345,000 would have been recorded at the inception of the lease. On December 31, 2017, the current portion of the liability would have been $23,925.

The interest expense arising from the lease in fiscal 2017 would have been $34,500. On December 31, 2017, the remaining liability, including the current portion, would have been $323,250.

• There would be no effect on the tax expense for the year.

Required:

a. Prepare revised financial statements for 2017 assuming that Fodhia treated the leases as capital leases instead of as operating leases.

b. Calculate the following ratios for 2017, first using the financial statements as initially prepared by Fodhia and then using the revised statements you prepared in part (a):

i. debt-to-equity ratio

ii. Return on assets

iii. Return on equity

iv. Profit margin ratio

v. Current ratio

vi. Asset turnover

vii. Earnings per share

viii. Interest coverage ratio

c. Discuss the differences between the two sets of ratios you calculated in part (b). Why are the ratios different? How might users of the financial statements be affected by these differences? Which set of ratios gives a better perspective on the performance, liquidity, and leverage of Fodhia? Explain.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Asset Turnover

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio. Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: