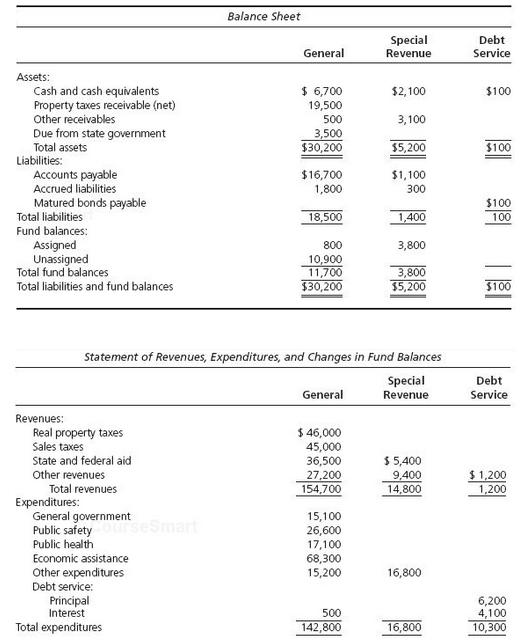

Following are extracts from the financial statements of Elisa County for the year ended December 31, 2013.

Question:

Following are extracts from the financial statements of Elisa County for the year ended December 31, 2013. The funds shown are the governmental operating funds; Capital Projects Funds are omit-ted. (All amounts are in thousands of dollars.)

Use the preceding information to compute the following ratios for Elisa County:

a. Quick ratio (aggregated governmental operating funds)

b. Property tax receivable rate

c. Operating margin, computed separately for General Fund and for aggregated operating funds

d. Budgetary cushion, for General Fund only

e. Debt service burden ( aggregated General and Debt Service Funds)

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction to Governmental and Not for Profit Accounting

ISBN: 978-0132776011

7th edition

Authors: Martin Ives, Terry K. Patton, Suesan R. Patton

Question Posted: