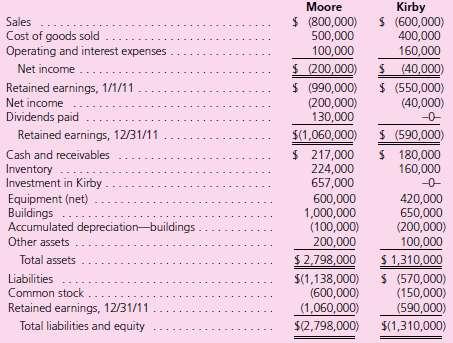

Following are financial statements for Moore Company and Kirby Company for 2011: Moore purchased 90 percent of

Question:

Following are financial statements for Moore Company and Kirby Company for 2011:

Moore purchased 90 percent of Kirby on January 1, 2010, for $657,000 in cash. On that date, the 10 percent noncontrolling interest was assessed to have a $73,000 fair value. Also at the acquisition date, Kirby held equipment (4-year remaining life) undervalued on the financial records by $20,000 and interest-bearing liabilities (5-year remaining life) overvalued by $40,000. The rest of the excess fair value over book value was assigned to previously unrecognized brand names and amortized over a 10-year life.

• During 2010 Kirby earned a net income of $80,000 and paid no dividends.

• Each year Kirby sells Moore inventory at a 20 percent gross profit rate. Intra-entity sales were $145,000 in 2010 and $160,000 in 2011. On January 1, 2011, 30 percent of the 2010 transfers were still on hand and, on December 31, 2011, 40 percent of the 2011 transfers remained.

• Moore sold Kirby a building on January 2, 2010. It had cost Moore $100,000 but had $90,000 in accumulated depreciation at the time of this transfer. The price was $25,000 in cash. At that time, the building had a five-year remaining life.

Determine all consolidated balances either computationally or by using a worksheet.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Advanced Accounting

ISBN: 978-0077431808

10th edition

Authors: Joe Hoyle, Thomas Schaefer, Timothy Doupnik