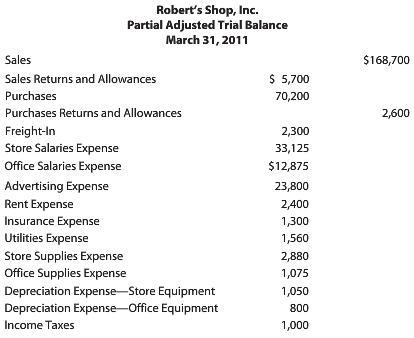

Following are selected accounts from the adjusted trial balance for Roberts Shop, Inc., as of March 31,

Question:

Following are selected accounts from the adjusted trial balance for Robert’s Shop, Inc., as of March 31, 2011, the end of the fiscal year.

The merchandise inventory for Robert’s Shop was $38,200 at the beginning of the year and $29,400 at the end of the year.

1. Using the information given, prepare an income statement for Robert’s Shop, Inc. Store Salaries Expense, Advertising Expense, Store Supplies Expense, and Depreciation Expense—Store Equipment are selling expenses. The other expenses are general and administrative expenses. The company uses the periodic inventory system. Show details of net sales and operating expenses.

2. Based on your knowledge at this point in the course, how would you use the income statement for Robert’s Shop to evaluate the company’s profitability? What other financial statements should you consider and why?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer: