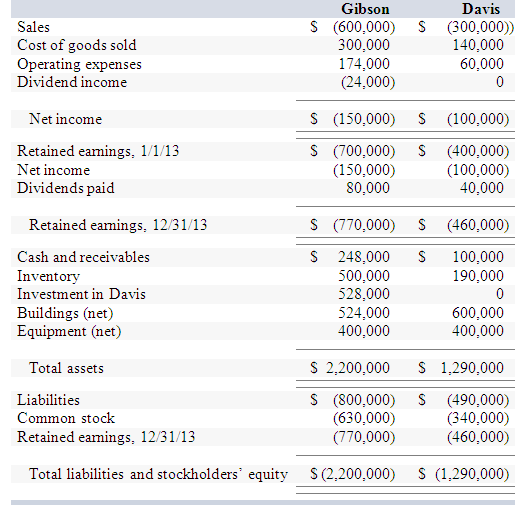

Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2013:

Question:

Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2013:

Gibson acquired 60 percent of Davis on April 1, 2013, for $528,000. On that date, equipment owned by Davis (with a five-year remaining life) was overvalued by $30,000. Also on that date, the fair value of the 40 percent non-controlling interest was $352,000. Davis earned income evenly during the year but paid the entire dividend on November 1, 2013.

a. Prepare a consolidated income statement for the year ending December 31, 2013.

b. Determine the consolidated balance for each of the following accounts as of December 31, 2013:

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Consolidated Income Statement

When talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 978-1259444951

13th edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupni

Question Posted: