For the year ended December 31, 2012, Telmarine Electrical Repair Company reports the following summary payroll data.

Question:

For the year ended December 31, 2012, Telmarine Electrical Repair Company reports the following summary payroll data.

Gross earnings:

Administrative salaries????.. ?$200,000

Electricians? wages?????? ?370,000

Total???????????.. ? $570,000

Deductions:

FICA taxes????????? ?$ 38,800

Federal income taxes withheld?. ?174,400

State income taxes withheld (3%).. ?17,100

United Fund contributions payable.. ?27,500

Health insurance premiums??.. ?17,200

Total???????????.. ?$275,000

Telmarine Company?s payroll taxes are: FICA 8%, state unemployment 2.5% (due to a stable employment record), and 0.8% federal unemployment. Gross earnings subject to FICA taxes total $485,000, and gross earnings subject to unemployment taxes total $135,000.

Instructions

(a) Prepare a summary journal entry at December 31 for the full year?s payroll.

(b) Journalize the adjusting entry at December 31 to record the employer?s payroll taxes.

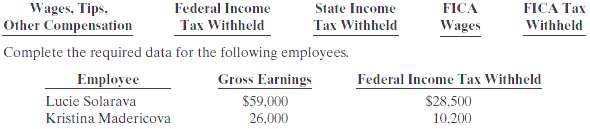

(c) The W-2 Wage and Tax Statement requires the following dollar data.

Step by Step Answer:

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso