(For this problem, you will want to use a calculator.) A developer would like to build an...

Question:

(For this problem, you will want to use a calculator.) A developer would like to build an amusement park in the midst of the once-thriving city of Broken Axle, Michigan. In order to build this park, he must purchase all of the land in a specific 10-acre area. If he does not get all of this land, he cannot build the park. Nobody except the developer knows exactly how much he would be willing to pay for the land. All persons other than the developer believe that the probability that he is willing to pay at least $p for the land is G(p) = e−p/k where k = 200, 000.

(a) Suppose that all of the land belongs to a single owner. This owner values the land at $50,000 in its current use. He must make a take-it-or leave-it offer to the developer. The owner wants to make an offer p that maximizes his expected profit from the sale, which is (p − $50,000)G(p). At what price should the owner offer the land? ________ At this price, what is the probability that the developer will buy the land? e−1.25 = ________ How much is the owner’s expected profit? __________

(b) Suppose that instead the land consists of 10 separate parcels with 10 different owners. Let vi be owner i’s value for his own parcel if he keeps it. These owners have different values vi and only the owner knows what it is worth to himself. Let us assume that v = ∑10i=1 vi = $50,000. Suppose that each owner i sets a price pi for his land. Let us define p to be the sum of these individual offer prices. That is, p = ∑10i=1 pi. If the developer is willing to pay at least p for the entire 10-acre parcel, then he buys it and pays each owner i, the amount pi. In equilibrium, each owner makes the offer that maximizes his expected profit given the offers made by the other owners. That is, he chooses pi to maximize

(pi − vi)G(p) = (pi − vi)e – ∑pj/k

where k = $200, 000. What price pi will owner i set? vi + k = vi + __________ What is the sum of the prices asked by the 10 owners? ___________ What is the probability that the developer will buy the land at this price? e−10.25 = ________ What is the sum over all 10 owners of expected profits? ________

(c) The 10 separate owners recognize that if they could somehow coordinate their offers, they would make much larger expected total profits. They decide to use the VCG mechanism to do so. In this instance the VCG mechanism works as follows. Each individual states an amount ri that the land is worth to him. All of the land will be offered to the developer at a price p that would maximize total profits of owners if each owner reports his actual value, ri = vi. If the developer chooses to purchase the land, then each owner will receive an equal share of the sales price p. In addition to receiving this share if the sale is made, each owner will pay a “tax” that depends on his response ri and on the responses of the other owners in the following way. Person i will receive an amount the sum of the expected profits of the other 9 owners, but must pay an amount equal to the maximum expected profits that would be received by the other owners if the price were chosen to maximize the expected total profits of these other owners. With this mechanism, the best strategy for each owner is to state his true value ri = vi. If each owner uses this best strategy, at what price will the land be offered to the developer? ________ What is the probability that the developer will buy the land? e−1.25 = __________

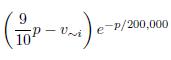

(d) Suppose that person i has a reservation price vi = $5, 900. Let us calculate the tax that the VCG mechanism would assign to i if each individual responds with ri = vi. If the land is offered at price p to the developer, then expected profits of persons other than i will be

where v∼i = ∑j≠i vj = ________ is the sum of the reservation prices of persons other than i. We found that if everyone responds optimally in the VCG mechanism, the land will be offered at a price of __________. Therefore the expected profits of persons other than i will be _____________________. The price p that maximizes the sum of expected profits of owners other than i is _____________. At this price, total expected profits of these owners would be ______________. The net tax that i pays is the difference between this amount and the actual expected profits of other owners. This difference is _________

(e) Let us calculate total expected profit of the individual with vi = $5900 under the VCG mechanism. Whether or not there is a sale, person i pays the amount of tax that we calculated in the previous section. With probability _________, the land is sold at price _____________ and each owner will receive 1/10 of the sales price, which is __________, giving him a profit of ___________________ over his reservation value. Therefore the expected profit for person i is __________________________

(f) If individual j has vj = $5, 000, what is the net amount of tax that he pays under the VCG mechanism? _________

Step by Step Answer: