Frankly, if we continue to grow, we will be out of business soon. This was the glum

Question:

Frankly, if we continue to grow, we will be out of business soon.”

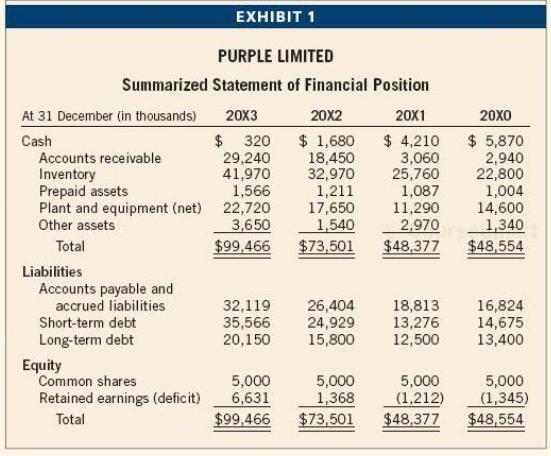

This was the glum assessment of Kathy Lin, President and CEO of Purple Limited, a company that designs, manufactures, and retails women’s fashion. Kathy has a 30- year history in the fashion business and has managed her own label for much of that time. In 20X0, she incorporated Purple, and the company grew rapidly. It was particularly known for its edgy fashion design, reasonable prices, and quick turnaround. Purple hires young designers and has established a highly efficient manufacturing and distribution system to place trendy clothes in stores ahead of her competition. Initially, designs had been sold only in Purple’s own stores, but over the last two years, Purple began selling to larger chains. As a result, the scope of Purple has significantly increased as have revenues and profits. In fact, the company reported a loss of $ 1,345 in 20X0 but moved to earnings of $ 133 in 20X1, earnings of $ 2,580 in 20X2, and an impressive $ 6,245 in 20X3 ( All figures in thousands.) Sales had more than tripled over the past three years. Capital assets purchased over this period were $ 16,000 in 20X0, $ 9,500 in 20X2, and $ 8,000 in 20X3.

“We are pretty much out of cash, and I have bills to suppliers that are due. My banker will provide some cash, but not enough to keep up with this— and all that borrowing is getting expensive. I’m not sure how we can post such high earnings and be so broke. Can you explain this to me and help me with a plan to get out of this mess? I need good advice, fast.” You are an accounting professional in public practice and have provided business advice to Kathy in the past. You agree to meet with her on this issue tomorrow and now are pre-paring a draft report for discussion. You decide that calculating cash flows from operating activities is a good place to start (Exhibit 1).

Required:

Prepare the draft report for discussion.

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0071339476

Volume 1, 6th Edition

Authors: Beechy Thomas, Conrod Joan, Farrell Elizabeth, McLeod Dick I