Gail and Harry own the GH Partnership, which has conducted business for 10 years. The bases for

Question:

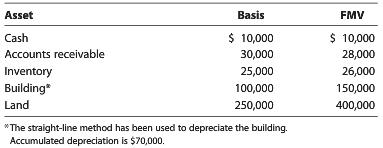

Gail and Harry own the GH Partnership, which has conducted business for 10 years. The bases for their partnership interests are $100,000 for Gail and $150,000 for Harry. GH Partnership has the following assets:

Gail and Harry sell their partnership interests to Keith and Liz for $307,000 each.

a. Determine the tax consequences of the sale to Gail, Harry, and GH Partnership.

b. From a tax perspective, would it matter to Keith and Liz whether they purchase Gail's and Harry's partnership interests or the partnership assets from GH Partnership?

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted: