Games N More operates a chain of retail stores that sell primarily puzzles, board games, and video

Question:

Games ’N More operates a chain of retail stores that sell primarily puzzles, board games, and video games. The manager of each store receives a bonus based on annual store results. The company’s CEO, Amanda Hargrove, is currently evaluating last year’s performance. Most stores experienced lower than expected sales because of increasing competition from Internet retail companies. In the past, the managers were evaluated based on store results compared to budgets. However, the company’s CFO recently attended a seminar on relative performance evaluation and recommended that Amanda consider evaluating manager performance based on how well each store performed relative to other stores in the chain.

Managers are required to place all inventory orders through the corporate purchasing department to enable the company to take advantage of quantity discounts. However, managers make their own decisions about selling prices, product mix, sales promotions, and staffing levels. The corporate office conducts marketing research, and the store managers meet quarterly to discuss customer purchasing trends and competition. Amanda negotiates with each store manager to develop annual budgets, but she insists on setting challenging budget targets to encourage managers to continuously improve store results. For example, the current year’s budgets assumed a 10% increase in sales over the prior year even though the company faced greater competition. In addition, the cost of goods sold budget was set at 60% of sales even though the prior year’s average was 65%. Amanda believed the managers could meet this target by increasing their emphasis on higher-margin products.

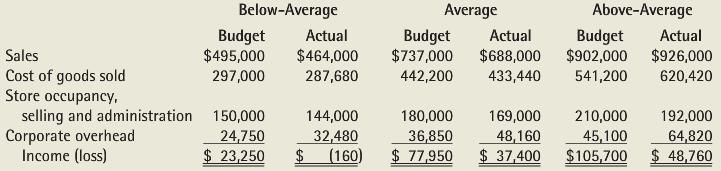

Amanda decided to investigate the idea of relative performance evaluation by considering the performance of three stores with below-average, average, and above-average results. All 20 of the company’s stores have roughly the same amount of retail space. Store occupancy, selling, and administration are primarily fixed costs. Corporate overhead is allocated to each store based on sales revenue. Budgets and results for these stores were as follows for the past year

REQUIRED

A. Analyze the performance of the managers of these 3 stores under the current performance evaluation system (actual compared to budget):

1. Should each manager be held responsible for sales plus all of the costs for his or her store? Explain your reasoning.

2. Calculate variances that would be appropriate for evaluating the performance of each manager.

3. Based on the variance calculations which, if any, of the managers should receive a bonus? Explain your reasoning.

B. Analyze the performance of the managers of these 3 stores using the following relative performance evaluation system:

1. Calculate the prior year’s actual sales, and then calculate the percent change in actual sales for each store. What does this information suggest about each manager’s performance?

2. Calculate actual cost of goods sold as a percent of sales for each store. What does this information suggest about each manager’s performance?

3. Identify several possible reasons why actual fixed costs are different across the three stores. (Assume that all costs other than cost of goods sold are fixed costs.) What do differences in fixed costs suggest about each manager’s performance?

4. Based on your preceding analysis which, if any, of the manager’s should receive a bonus? Explain your reasoning.

C. Describe the strengths and weaknesses of each performance evaluation system.

Step by Step Answer:

Cost Management Measuring Monitoring and Motivating Performance

ISBN: 978-0470769423

2nd edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott