Giant Jets is a French company that produces jet airplanes for commercial cargo companies. The selling price

Question:

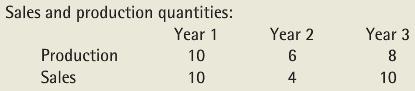

Giant Jets is a French company that produces jet airplanes for commercial cargo companies. The selling price (in euros) per jet is €1,000,000. Currently the company uses actual volumes to allocate fixed production overhead to units. However, Giant Jets’ accountant is considering the use of standard costs to produce the absorption income statements. The company anticipates the following.

Variable costs per jet:

Direct materials ………………………......…… €200,000

Direct labor ………………………….........…….. 150,000

Variable production overhead …………….. 50,000

Variable selling ……………………………......... 100,000

Fixed costs per year:

Fixed production overhead …………..…… €600,000

Fixed administrative and selling ……..…. 100,000

REQUIRED

A. Prepare income statements using the variable costing method.

B. Prepare income statements using the throughput costing method.

C. Prepare income statements using the absorption costing method. Allocate fixed overhead using actual units produced in the denominator.

D. In your own words, define normal capacity.

E. Prepare an income statement using the absorption cost method and choose a denominator level that represents normal capacity. Explain your choice for normal capacity.

F. Prepare a brief summary that reconciles the incomes among the four income statements (parts (A), (B), (C), and (E)) for each year.

Step by Step Answer:

Cost Management Measuring Monitoring and Motivating Performance

ISBN: 978-0470769423

2nd edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott