Gildan Activewear Inc. is a Montreal-based manufacturer of branded activewear. Since going public in 1998, Gildans common

Question:

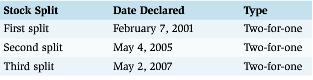

Gildan Activewear Inc. is a Montreal-based manufacturer of branded activewear. Since going public in 1998, Gildan€™s common shares have been split as follows:

Gildan announced in December 2010 that it would introduce a quarterly dividend. It has paid the following dividends up to January 2014:

Payment monthDividends per share

March, June, and September 2011...$0.075

January, March, June, and September 2012.$0.075

January, March, June, and September 2013.$0.090

January 2014...........$0.108

Required:

a. If you had purchased 100 shares of Gildan when the company went public in 1998 and not bought or sold any shares since, how many shares would you currently own?

b. What is the total amount of dividends you would have received by the end of January 2014?

c. What can you infer about the growth of Gildan from the frequency of stock splits and its decision to introduce a quarterly dividend in December 2010?

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 978-1118849385

1st Canadian Edition

Authors: Christopher Burnley, Robert Hoskin, Maureen Fizzell, Donald