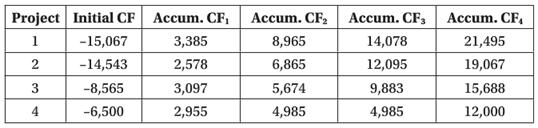

GiS Inc. has the following four projects on hand: The cash flow in the table is accumulative.

Question:

GiS Inc. has the following four projects on hand:

The cash flow in the table is accumulative. Assume that RF = 5%, ERM = 12%, firm-beta = 1.2, after-tax cost of debt = 6.5%. The firm is financed by 40-percent debt and 60-percent equity. Projects 1, 2, and 3 have the same capital structure as the firm, while project 4 has a 1-percent risk premium. Calculate the cost of capital for the four projects using the following methods:

a. The payback period for projects 1, 2, and 3: If the cut-off period for screening projects 1 and 2 is 3.5 years and for project 3 is 2.25 years, which project(s) should be rejected?

b. The discounted payback period method for project 4: If the cut-off period for screening project 4 is 3.25 years, should it be accepted?

Capital StructureCapital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Cost Of Debt

The cost of debt is the effective interest rate a company pays on its debts. It’s the cost of debt, such as bonds and loans, among others. The cost of debt often refers to before-tax cost of debt, which is the company's cost of debt before taking... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Introduction To Corporate Finance

ISBN: 9781118300763

3rd Edition

Authors: Laurence Booth, Sean Cleary