GiS Inc. now has the following two projects available: Assume that RF = 5%, risk premium =

Question:

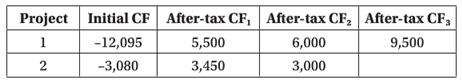

GiS Inc. now has the following two projects available:

Assume that RF = 5%, risk premium = 10%, and beta = 1.2. Use the chain replication approach to determine which project(s) GiS Inc. should choose if they are mutually exclusive.

Transcribed Image Text:

Project Initial CF After-tax CF, After-tax CF, After-tax CF, 1 -12,095 5,500 6,000 9,500 2 -3,080 3,450 3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (18 reviews)

Cost of capital r 5 1210 17 Only one of t...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Introduction To Corporate Finance

ISBN: 9781118300763

3rd Edition

Authors: Laurence Booth, Sean Cleary

Question Posted:

Students also viewed these Accounting questions

-

You are asked to evaluate the following two projects for the Norton Corporation. Using the net present value method combined with the profitability index approach described in footnote 2 of this...

-

You are considering the following two projects and can only take one. Your cost of capital is 11%. a. What is the NPV of each project at your cost of capital? b. What is the IRR of each project? c....

-

You are asked to evaluate the following two projects for Boring Corporation using the NPV method combined with the PI approach, which project would you select? Use a discount rate of 10 percent....

-

From the data below, how much is subject to regular income tax? * Description Interest income on savings deposits in local banks Income from sale of lot held for investment, located IN Compensation...

-

Examine the graphs of demand for schooling presented in Figure 19.1. a. Explain how per-capita income is taken into account in the analysis. b. What is the effect on welfare losses due to an enforced...

-

ALL l 1. Growth in 2 Dimensions Start with an infinite two dimensional grid filled with zeros, indexed from (1,1) at the bottom left corner with coordinates increasing toward the top and right....

-

Describe what acts a professional liability policy covers, as well as the risks it does not cover.

-

1. Identify the pros and cons of a JIT relationship from a suppliers point of view. 2. Identify the pros and cons of a JIT relationship from a buyers point of view. 3. What factors should Dixon and...

-

Wantaby Ltd. is extending its credit terms from 45 to 60 days. Sales are expected to increase from $471 million to $5.81 million as a result Wontaby finances short-term assets at the bank at a cost...

-

Which is the foundation of an accurate hotel sales forecast? a. Sales history b. Budget c. Number of rooms currently on the books d. Current guest arrival list

-

MedCo, a large manufacturing company, currently uses a large printing press in its operations and is considering two replacements: the PDX341 and PDW581. The PDX costs $500,000 and has annual...

-

Solve Practice Problem 56 using EANPV and assuming the market risk premium is 10 percent.

-

1. The court ruled that the FECs rationale was not of ideal clarity. Shouldnt an agency have to at least be clear about its rationale to avoid a finding of arbitrariness? 2. Why do you think Van...

-

A beam having a tee-shaped cross section is subjected to equal 7 kN-m bending moments, as shown. Assume b= 110 mm, t+= 25 mm, d = 150 mm, tw = 35 mm. The cross-sectional dimensions of the beam are...

-

Under the doubleentry bookkeeping system, the full value of each transaction is recorded on the debit side of one or more accounts and also on the credit side of one or more accounts. Therefore, the...

-

List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the instructions and list this interest first. Also, show that...

-

Assume Mr. J. Green invests $15,000 to start a landscape business. This transaction increases the company's assets, specifically cash, by $15,000 and increases owner's equity by $15,000. Notice that...

-

and errore extraordinary items. 3.3 Use the following information for Zohrain Corporation given at the end of 2019. Current Assets Current Liabilities Fixed Assets, Net- Investments Long-Term Debt-...

-

We wish to explore various reactor setups for the transformation of A into R. The feed contains 99% A, 1% R; the desired product is to consist of 10% A, 90% R. The transformation takes place by means...

-

In Exercises discuss the continuity of each function. f(x) -3 1 x - 4 y 3 2 -1 -2 -3+ 3 X

-

A particle of mass \(9.1 \times 10^{-31} \mathrm{~kg}\) and carrying an unknown quantity of charge is shot at a velocity of \(2.0 \times 10^{4} \mathrm{~m} / \mathrm{s}\) to the right and enters the...

-

What are the two main components of the required rate of return on equity securities?

-

In what ways are preferred shares different from bonds?

-

Why is share value based on the present value of expected future dividends?

-

I. Analyze the geometric construction of the systems shown as in figures. A Figure 1-1 E Figure 1-2 Figure 1-3 bisg ela ad bloode vuilidizel Figure 1-4

-

structural engineering course, i need it asap please. thanks A. Calculate the reactions of the two-span frame shown in figure Figure 4-1 2.5kN/m (a) D E F A B 2m 2m 4m 0 4m B. Calculate member-end...

-

As a hired structural engineering consultant, you were requested to evaluate a four-story building that is damaged by a Magnitude 6 earthquake. The client has no background in any civil/structural...

Study smarter with the SolutionInn App